Multifamily CRM: A Complete Guide for Institutional Property Operators

Multifamily CRM (Customer Relationship Management) platforms are built to manage prospect engagement, leasing pipelines, and communication across apartment portfolios. For institutional owners, a CRM is more than a marketing tool, it’s a core driver of leasing velocity, revenue predictability, and operational accountability.

But most explanations of multifamily CRM stay at the surface level: “track leads, send emails, schedule tours.”

For VP Operations, Asset Managers, and institutional ownership groups, the real questions are different:

-

Does the CRM improve conversion at the portfolio level?

-

Does it align with underwriting assumptions and rent strategy?

-

How does it interact with the PMS, and where do errors creep in?

-

Can it support centralized leasing and distributed teams at the same time?

-

How does it impact NOI, not just occupancy?

This guide breaks down what multifamily CRM actually is, how it differs from property management software, the metrics that matter for institutional portfolios, and how intelligence layers like SurfaceAI fit into the picture.

For a broader view of the modern tech stack, you may also want to read the Multifamily Technology & Software: A Modern Guide →

What Is a Multifamily CRM?

A multifamily CRM is a system designed to:

-

Capture and route leads

-

Track every prospect touchpoint

-

Manage the leasing pipeline from first inquiry to signed lease

-

Standardize follow-up and communication across teams and properties

-

Report on leasing performance at the property and portfolio level

It sits upstream from your Property Management System (PMS).

Where the PMS is the system of record for executed leases and resident data, the CRM is the system of engagement for prospects and pre-lease workflows.

Typical capabilities include:

-

Web and ILS lead capture

-

Automated lead routing and assignment

-

Integrated email, phone, and SMS tracking

-

Tour scheduling and confirmations

-

Application stage tracking

-

Leasing funnel analytics and reporting

If you think of your multifamily portfolio as a revenue engine, the CRM is the component that determines how efficiently prospect demand converts into signed leases. Multifamily Executive’s analysis of revenue management software shows how metrics like rent growth and occupancy have evolved together, and the CRM plays a foundational role in that equation.

For a deeper look at how operational software underpins property performance, see the Multifamily Property Management Technology & Software guide.

Multifamily CRM vs Property Management Software

One of the most common sources of confusion at the executive level is the overlap between CRM features and PMS marketing modules.

It helps to draw a clear line:

-

Multifamily CRM

-

Manages prospect data

-

Tracks lead-to-lease workflows

-

Focuses on conversion, speed, and engagement

-

-

Property Management System (PMS)

-

Manages resident and lease data

-

Handles rent, accounting, and operations

-

Focuses on collections, compliance, and reporting

-

A CRM is not a replacement for PMS, and PMS is not a true CRM.

The risk for institutional portfolios is assuming that because the PMS has some “CRM-like” features, that’s enough. In reality, that often leads to:

-

Fragmented lead tracking

-

Inconsistent follow-up across properties

-

Poor visibility into channel performance

-

Misalignment between marketing spend and actual signed leases

As Bisnow reported, operators who switch to purpose-built CRM platforms, rather than relying on PMS add-ons, consistently see faster response times and measurable improvements in lead-to-lease conversion rates.

To see how PMS and oversight tools intersect more broadly, you can reference Real Estate Asset Management Software →

Core Capabilities of a Multifamily CRM

1. Lead Capture and Attribution

Modern multifamily CRM platforms pull leads from:

-

ILS and listing sites

-

Property websites

-

Paid search and social campaigns

-

Referral programs

-

Call centers and chat

The CRM should:

-

Automatically capture all leads with no manual entry

-

Tag each lead with source and campaign

-

De-duplicate records so the same person doesn’t appear as three different leads

-

Track how quickly each new lead receives a first response

This is the foundation for understanding cost per signed lease by channel, something asset managers care about far more than raw lead volume. As Multifamily Executive notes, almost all apartment operators have now implemented some form of lead management software, making attribution quality a key differentiator rather than table stakes.

2. Leasing Pipeline Management

A strong multifamily CRM visualizes the leasing funnel:

-

New lead

-

Contacted

-

Toured / scheduled tour

-

Applied

-

Approved

-

Lease signed

This enables operators to answer questions like:

-

Where do prospects stall most frequently?

-

Which properties have weak tour-to-application conversion?

-

Which leasing agents consistently outperform or underperform?

-

How closely does leasing velocity match underwriting assumptions?

Thesis Driven’s analysis of next-generation multifamily metrics illustrates how operators are now moving beyond occupancy as a single benchmark and using pipeline data to drive staffing, pricing, and NOI decisions in real time.

For teams that want to tie this into broader operational automation, our article on Property Management Workflow Automation explains how leasing-related workflows connect to the rest of the property stack.

3. Automated Communications and Follow-Up

Most multifamily CRMs now offer:

-

Automated first-touch responses

-

Drip sequences for unresponsive leads

-

Tour reminders via SMS/email

-

Application nudges

-

Post-tour follow-up templates

These reduce manual follow-up work and enforce minimum response standards across the portfolio.

However, automating messages is not the same as intelligently prioritizing which leads are most likely to convert. That’s where AI-enhanced workflows start to enter the picture. Multifamily Dive’s research on property manager technology adoption found that 28% of operators planned to adopt AI tools in the past year, up from 14% the year before, with lead quality and occupancy cited as the top drivers.

4. Conversational AI and Leasing Chatbots

Many operators now layer conversational AI on top of or alongside their CRM:

-

Answering inquiry questions 24/7

-

Providing real-time availability info

-

Scheduling tours directly on the website

-

Handling basic qualification questions

Propmodo’s analysis of the AI chatbot shift in multifamily notes that the economics are driving rapid adoption: AI handles lead engagement across extended hours at a fraction of the cost of additional staffing, while human agents focus on closing. According to data from Propmodo, 61% of people either use or plan to use a chatbot in their apartment search in 2025.

If you’re exploring this space, our piece on AI Leasing Assistants dives into how apartment chatbots and multifamily website chatbots fit into the leasing process.

In most cases, conversational AI improves responsiveness and consistency, but it still feeds into the CRM and PMS, where data integrity must be protected.

Why a Generic CRM Isn’t Enough for Multifamily

Some operators consider using horizontal CRMs (built for general sales teams) for multifamily use cases.

The problem is that traditional sales CRMs are not designed to:

-

Handle unit-level availability

-

Sync accurately with rent roll and PMS data

-

Manage tour scheduling complexities

-

Align with fair housing and regulatory requirements

-

Scale across dozens or hundreds of properties with different ownership structures

As a result, they often become:

-

Over-customized and fragile

-

Dependent on workarounds and manual data entry

-

Poorly adopted by onsite teams

Purpose-built multifamily CRM platforms reflect the operational reality of leasing, not just generic “sales pipeline” logic. The NAA’s compliance guidance makes clear that the consequences of non-compliance, including fair housing violations, can include lawsuits, fines, and loss of operating licenses, making platform fit a legal risk factor as well as an operational one.

How Multifamily CRM Impacts Portfolio Performance

For institutional owners and asset managers, the CRM’s value is measured in:

-

Leasing velocity – How quickly vacant units move from “listed” to “occupied”

-

Conversion rates – Lead-to-tour, tour-to-application, application-to-lease

-

Stabilization timelines – How rapidly newly acquired or developed properties hit target occupancy

-

Rent strategy execution – Whether pricing and concessions are applied as underwritten

A strong CRM makes these patterns visible. A weak or poorly integrated CRM hides them in fragmented spreadsheets and ad hoc reports. As Bisnow’s reporting on multifamily REIT performance shows, with same-store NOI under pressure across major REITs in 2026, operators are leaning harder on leasing efficiency as a lever and the CRM sits at the center of that effort.

For a view of how these leasing metrics roll up into investment performance, see the broader discussion in AI for Real Estate: Transforming Ops →

The Blind Spot: What Happens After the Lease Is Signed

There is a critical handoff point in every multifamily leasing workflow:

CRM → PMS → Financial Reporting

Most CRMs are not designed to verify that:

-

The rent rate, fees, and concessions that were quoted in the CRM are identical to what ends up in the PMS

-

All required addenda and documents were properly executed

-

Lease terms align with underwriting assumptions and policy rules

Common breakdowns include:

-

Concessions entered incorrectly or inconsistently

-

Amenity or pet fees that were approved but never charged

-

Missing or unsigned documents that create compliance risk

-

Inconsistent move-in dates and pro-ration logic

The CRM is effectively blind to these downstream errors. It considers a lease “won” once it’s signed, even if execution is flawed. CRETI data cited in a recent Multifamily Dive report found that 60% of property managers encounter financial discrepancies monthly and 40% report quarterly mismatches, a direct consequence of this handoff gap.

For how operators address these downstream gaps, see Lease Automation AI Technology and Automated Lease Auditing Solution →

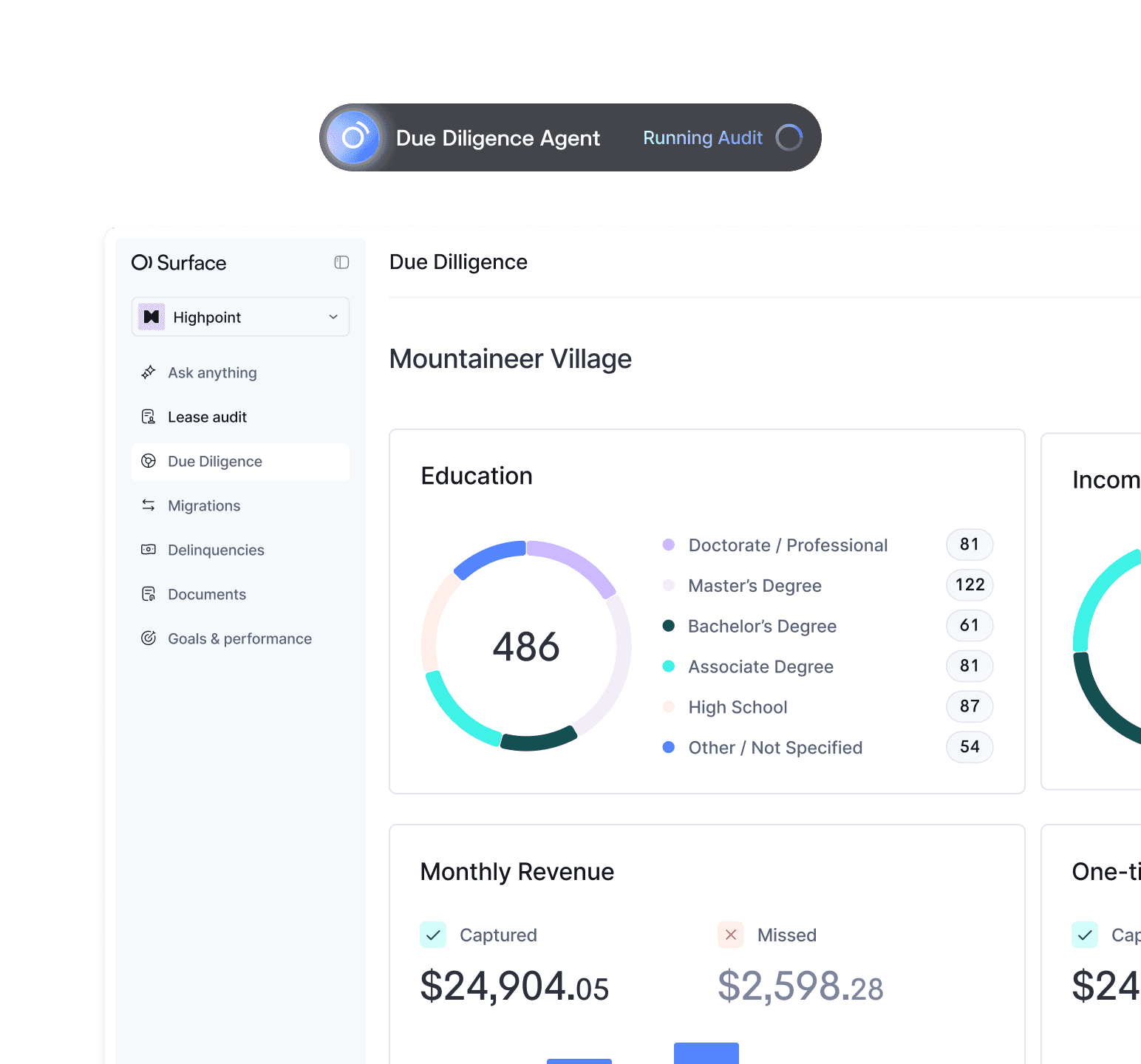

Where SurfaceAI Fits: Intelligence Beyond the CRM

SurfaceAI does not replace your multifamily CRM.

Instead, it acts as an intelligence and control layer across the systems your CRM hands off to:

-

PMS

-

Document storage

-

Reporting tools

While the CRM optimizes how quickly and efficiently you get leases signed, SurfaceAI focuses on:

-

Whether those leases are correct

-

Whether they match policy and underwriting

-

Whether they’re stored and tracked properly

-

Whether they create hidden revenue or compliance risk

For example, the Lease Audit AI Agent continuously reviews lease data and documents to:

-

Flag missing or incorrect charges

-

Identify out-of-policy concessions

-

Spot mismatches between leases and rent rolls

-

Surface issues before they show up in financials

Similarly, the Due Diligence Agent and Document Management Agent (covered in more depth in AI Due Diligence → and related articles) extend oversight into acquisitions and collections.

The result is a stack that looks like this:

-

Multifamily CRM – Drives leasing velocity

-

PMS / Accounting – Maintains financial records

-

SurfaceAI – Validates, monitors, and protects the integrity of what flows through both

Evaluating the Best CRMs for Multifamily Property Management

When operators ask, “What is the best CRM for multifamily?” the more useful question is:

“Which CRM is best for our PMS, team structure, and portfolio strategy?”

Key evaluation criteria include:

1. PMS Integration Depth

-

Does the CRM have native integrations with your PMS?

-

How does data sync, real time, nightly batch, manual export?

-

Are rent and fee fields mapped reliably?

Weak integrations create reconciliation work and increase the risk of misaligned lease data.

2. Leasing Model: Onsite vs Centralized

-

Do you run leasing at the property level, regionally, or through a centralized hub?

-

Can the CRM handle shared pipelines, pooled leads, or call centers?

-

Can it enforce consistent follow-up standards across properties?

If you’re exploring centralized models, you’ll likely also be thinking about automation and AI. Our article on Multifamily AI Automation provides context on where leasing fits in that transition.

3. Reporting and Portfolio Visibility

-

Can you see leasing performance by region, brand, or ownership group?

-

Can you easily compare properties against each other?

-

Does the CRM provide data exports that feed into asset management and reporting workflows?

For more on the reporting side, see Real Estate Reporting Software, which explores how operators move from static monthly reports to real-time visibility.

4. Governance, Compliance, and Fair Housing

-

Does the CRM maintain a clear communication history for each prospect?

-

Can you standardize templates and workflows to reduce risk?

-

Is there sufficient access control and permissioning for large teams?

CRMs are not compliance systems, but sloppy configuration can create exposure. Ensuring alignment with compliance processes and backing it with downstream audit tools, is critical.

How AI Is Changing the Multifamily CRM Category

As AI capabilities mature, multifamily CRM platforms are incorporating:

-

Lead scoring based on engagement and profile

-

AI-generated follow-up content and suggested next actions

-

Pattern detection across high-performing leasing reps and properties

-

Smart routing (e.g., sending high-intent leads to the most effective team)

At the same time, AI agents like those in SurfaceAI operate outside the CRM, working directly on:

-

Lease files

-

Rent rolls

-

Financial reports

-

Due diligence datasets

Our piece on AI for Real Estate: Transforming Ops explains how these layers complement each other, CRM-side AI to generate demand and operational AI to protect the resulting revenue.

Building a Multifamily Stack Around CRM and Intelligence

A modern enterprise multifamily stack often looks like:

-

Core PMS – System of record

-

Multifamily CRM – Leasing and prospect engine

-

Marketing tools – ILS, paid media, website

-

AI leasing assistants – Chat and automation at the top of funnel

-

SurfaceAI – AI agents handling continuous audit, diligence, delinquency, and document management

-

Reporting / BI – Portfolio dashboards and investor reporting

Each system has a clear purpose. The failure mode comes when operators expect one tool to play all roles, for example, stretching the CRM into asset management, or expecting the PMS to handle continuous audit.

SurfaceAI is intentionally positioned as the intelligence layer that keeps the stack honest.

Frequently Asked Questions About Multifamily CRM for Institutional Operators

Related content