Real Estate Asset & Investment Management Software: Enhanced with AI Agents

What Is Real Estate Asset Management Software

Real estate asset management software is technology that centralizes portfolio data, automates operational workflows, and gives owners and operators visibility into how their properties are actually performing.

Think of it as the layer that sits above day-to-day property management, it’s less about collecting rent and handling maintenance tickets, and more about understanding whether your portfolio is healthy, compliant, and generating the revenue it’s supposed to.

The distinction from property management software (PMS) is important.

| PMS: Handles the daily grind | Asset management software: Handles portfolio-level questions. |

|---|---|

| Lease applications | Which properties are leaking revenue? |

| Work orders | Are lease terms being followed consistently? |

| Reactive delinquency follow-up | Where are the compliance gaps that could become legal problems? |

Why Portfolio Visibility is the Core Challenge

For operators managing more than a handful of properties, the core challenge is visibility. Data ends up scattered across rent rolls, lease PDFs, accounting systems, and cloud storage folders, a problem roughly 75% of the CRE industry contends with.

Without something that pulls all of this together, asset managers end up relying on reports that are already stale by the time they land on someone’s desk. AI-powered platforms change this by working continuously in the background, catching problems as they happen rather than weeks after the damage is done.

How AI Transforms Real Estate Portfolio Management

Traditional real estate portfolio management software was built for a world where quarterly reports and annual audits were good enough. That world doesn’t exist anymore. Operators now manage thousands of leases across dozens of properties, each with different terms, concessions, and compliance requirements. Manual processes can’t keep pace.

AI-native platforms take a fundamentally different approach. Instead of waiting for someone to ask a question or run a report, they monitor operations around the clock and act when something goes wrong.

From Periodic Reporting to Continuous Oversight

Legacy tools generate static reports at month-end or quarter-end. By the time an asset manager reviews the numbers, problems have already compounded. A missed charge in week one becomes a revenue gap by week four, and by then, it’s often too late to recover.

AI agents work differently. They monitor every lease change, every payment, every document upload in real time. When something deviates from policy, an unsigned addendum, an incorrect concession, a missing fee, the system flags it immediately. This shift from periodic to continuous oversight is one of the most meaningful operational improvements AI enables.

From Manual Audits to Automated Workflow Execution

Spreadsheet-based audits are slow and error-prone. A regional manager might spot-check 10 percent of leases and hope the sample tells the whole story. Meanwhile, the other 90 percent go unreviewed.

AI replaces this with automated detection and task assignment. When an issue surfaces, the system creates a task, assigns it to the right person, and tracks resolution. No one has to remember to check. No one has to manually route the problem. The workflow just runs.

From Siloed Data to Unified Portfolio Intelligence

Most operators store data across multiple systems. The PMS holds lease records, accounting software tracks financials, and cloud storage contains supporting documents. These silos create blind spots, and blind spots create risk.

AI platforms pull data from all of these sources into a single operational view. Rent rolls, lease PDFs, email threads, and financial records become searchable and analyzable from one place. This unification is what makes portfolio-wide intelligence possible in the first place.

Core Features of Real Estate Investment Management Software

The best asset management solutions for real estate companies share a common set of capabilities. Implementations vary, but these features represent the baseline for modern platforms.

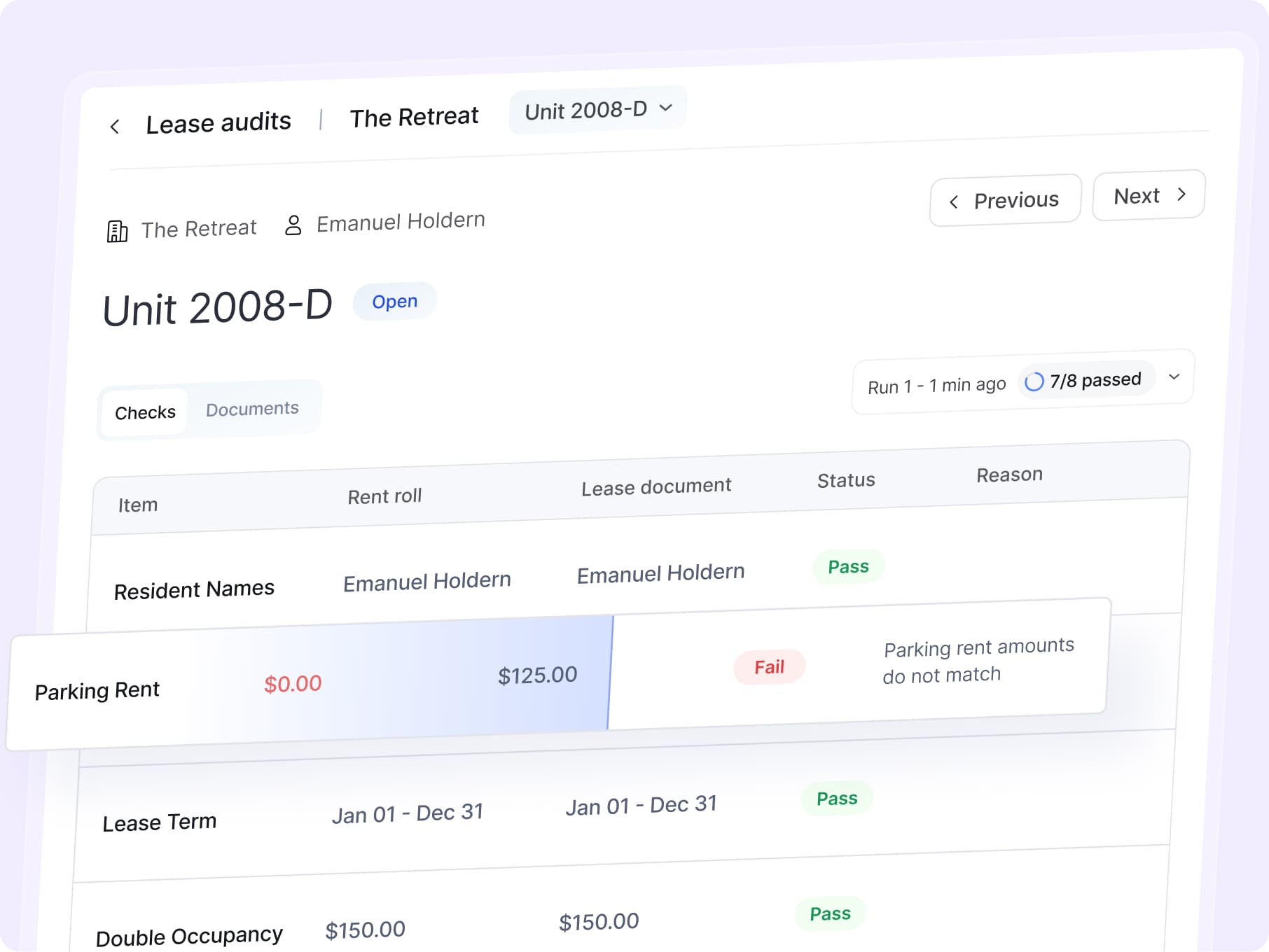

Continuous Lease and Revenue Auditing

Always-on monitoring catches missed charges, unsigned documents, and out-of-policy terms before they become financial problems.

- Revenue protection: Billing discrepancies get flagged before month-end close, when corrections are still straightforward

- Compliance tracking: Missing signatures and policy violations surface automatically, reducing legal exposure

Automated Due Diligence for Acquisitions

During acquisitions, teams traditionally spend weeks reviewing lease files by hand. AI extracts and analyzes resident data from rent rolls and lease documents, surfaces red flags, mismatched names, employment risk, payment history issues, and compresses the timeline from letter of intent to actionable insight.

Compliance Monitoring and Task Assignment

Detection alone isn’t enough. Effective platforms convert identified issues into assigned tasks with clear ownership and deadlines. This creates accountability and produces an audit trail that protects operators in disputes or regulatory reviews.

Centralized Data from PMS and Cloud Storage

Integrations with property management systems, OneDrive, SharePoint, and other repositories unify data that would otherwise stay fragmented. The platform becomes the single source of truth for portfolio operations.

Portfolio-Wide Visibility and Reporting

Dashboards and reporting tools give asset managers a consolidated view of NOI drivers, delinquency risk, and operational status across all properties. Instead of assembling reports from multiple sources, managers see everything in one place.

Role-Based Access for Onsite and Corporate Teams

Permission-aware access ensures leasing teams see what they need for daily operations, while regional managers and asset managers see portfolio-level insights. Security and relevance stay intact.

Why Real Estate Investment and Asset Management Relies on Software

Managing real estate investments requires oversight at every level, from lease compliance to portfolio reporting. Asset managers and operators face pressure to:

-

Track multiple assets across multifamily and commercial portfolios.

-

Audit leases and rent rolls for accuracy.

-

Ensure compliance and risk management.

-

Deliver transparent reporting to investors.

Real estate portfolio and asset management software has become the standard tool for centralizing this information. But while these platforms are excellent systems of record, they often lack the automation and intelligence required to handle daily revenue-critical workflows.

This is where AI agents that plug into your existing platforms make the difference.

What Portfolio Management Software Does (and What It Misses)

Traditional asset management software delivers:

-

Centralized lease and financial data.

-

Portfolio dashboards and investor reporting.

-

Accounting and rent roll management.

But it usually cannot:

-

Audit leases continuously.

-

Process thousands of documents during due diligence.

-

Monitor delinquency patterns and act automatically.

That’s where SurfaceAI’s agents extend the value of your existing PMS and portfolio software.

Key Benefits of AI-Powered Real Estate Portfolio Software

Operators who deploy AI-native asset management software see measurable improvements across revenue, compliance, and operational efficiency.

Reduced Revenue Leakage from Missed Charges

Continuous auditing catches billing errors, missing fees, and incorrect concessions that would otherwise go unnoticed until financial review, often too late to recover.

- Proactive detection: Issues surface at the moment they occur, not weeks later

- Task-driven resolution: Staff get assigned to fix discrepancies before revenue is lost

Revenue leakage from lease administration errors can quietly erode portfolio performance. For a 5,000-unit portfolio at $1,500 average rent, even small percentage losses add up quickly over the course of a year.

Faster Due Diligence and Shorter Acquisition Timelines

Automated lease and resident analysis replaces manual file reviews. Acquisition teams assess risk faster and close deals with greater confidence. What once took weeks can now happen in days.

Lower Compliance Risk and Eliminated Audit Backlogs

Always-on monitoring prevents the accumulation of unreviewed leases and unsigned documents. Operators maintain compliance posture continuously rather than scrambling before audits.

Scalable Portfolio Operations Without Added Headcount

AI agents handle repetitive workflows, audit, follow-up, document processing – so teams can grow portfolios without proportionally increasing staff. This scalability matters most for operators pursuing aggressive growth.

SurfaceAI: The Automation Layer for Asset & Investment Managers

SurfaceAI is not another property management or portfolio software.

It’s a suite of AI agents that integrate directly into your existing PMS and asset management platforms.

-

Lease Audit Agent → Ensures continuous accuracy in leases.

-

Due Diligence Agent → Speeds up acquisitions with automated reviews.

-

Delinquency Agent → Protects cash flow and streamlines collections.

-

Document Management Agent → Takes on the manual work of getting documents into your PMS during a takeover or acquisition

-

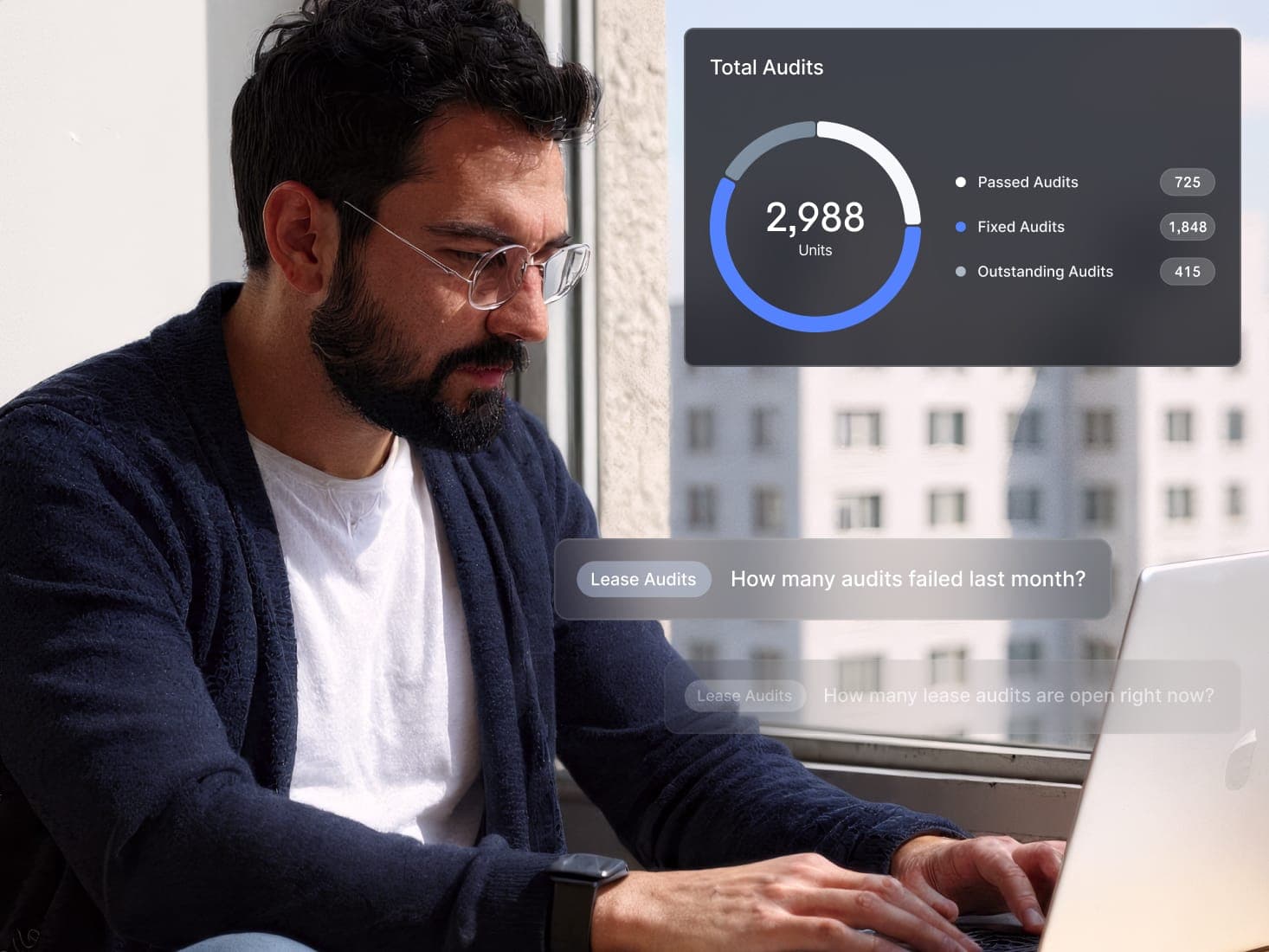

Workspace Hub → A central command center to manage agents and query portfolio data with “Ask Anything.”

Learn how SurfaceAI automation complements your portfolio management systems.

How SurfaceAI Agents Enhance Asset Management Software

Lease Audits

Most platforms only store lease data, they don’t validate it.

-

AI agents scan leases 24/7.

-

Flag errors, missed charges, or anomalies.

-

Maintain audit logs for compliance and investor reporting.

Explore SurfaceAI Lease Audit Agent →

“The audit program from SurfaceAI was a game-changer for us. This structure helped us identify and capitalize on missed opportunities for revenue, turning what was once a blind spot into a source of income.”

Glennette Calero, Property Manager

Due Diligence in Acquisitions

Large-scale acquisitions overwhelm manual teams and slow down transactions.

-

AI agents review thousands of leases in hours.

-

Highlight discrepancies across rent rolls.

-

Provide clear red-flag summaries for investors.

Explore SurfaceAI Due Diligence Agent →

Delinquency Monitoring & Collections

Portfolio software tracks payments, but it doesn’t predict or intervene.

-

AI agents detect delinquency trends early.

-

Automate escalation workflows.

-

Protect NOI and reduce manual collections workload.

Explore SurfaceAI Delinquency Agent (Beta) →

Document Management during takeovers

Manual document management consumes hours of admin time per week per property during asset takeovers

-

AI agent automatically classifies and labels all documents.

-

Agent matches each set of documents with residents.

-

Verified upload happens seamlessly in your into your PMS.

- Full migration completed in a fraction of the time.

Explore SurfaceAI Document Management Agent →

Portfolio-Level Insights

When integrated with your existing systems, AI agents provide:

-

Cross-portfolio intelligence on risk and compliance.

-

Predictive alerts before issues impact NOI.

-

A proactive “system of intelligence” layered onto your system of record.

How to Choose the Best Asset Management Solutions for Real Estate Companies

Selecting the right platform means evaluating capabilities against operational needs. Not all solutions are built the same, and the differences matter.

1. Prioritize Continuous Monitoring Over On-Demand Reporting

Platforms that run in the background constantly deliver more value than those that only respond to user requests. Always-on monitoring is a core capability worth prioritizing.

2. Evaluate AI Capabilities Beyond Basic Automation

Rule-based automation follows predefined scripts. AI agents analyze unstructured data, learn from context, and take action. The distinction affects what the platform can actually accomplish.

3. Confirm Workflow Automation with Task Assignment

Detection without action creates noise. Verify that the platform not only identifies issues but also creates and assigns tasks to the appropriate team members.

4. Assess Integration Depth with Core Systems

Check that the software connects to the specific PMS, accounting, and storage tools your organization uses. Shallow integrations limit value.

5. Review Role-Based Security and Permissions

Access controls should align with organizational structure and data sensitivity requirements. One-size-fits-all permissions create security risks.

Why AI-Native Platforms Are the Future of Real Estate Portfolio Manager Software

The shift from legacy tools to AI-native platforms reflects a broader change in how operators think about technology. Traditional software automates tasks. AI agents, described by PwC and ULI as agentic AI, act as digital teammates, monitoring, analyzing, and executing workflows without constant human direction.

This distinction matters because portfolio complexity keeps growing. More properties, more lease variations, more compliance requirements, more data sources. Manual processes and periodic reporting can’t scale to meet these demands.

AI-native platforms like SurfaceAI are built around this reality. Instead of bolting AI features onto legacy architecture, they’re designed from the ground up for continuous oversight and automated execution. The result is operational control that manual processes and traditional software simply can’t match.

For operators looking to protect NOI, reduce compliance risk, and scale without proportionally increasing headcount, AI-powered asset management software represents the clearest path forward, with Morgan Stanley projecting $34 billion in AI-driven real estate efficiency gains by 2030.

Book a demo to see how SurfaceAI’s AI agents automate lease audits, due diligence, and delinquency workflows across your portfolio.

FAQs about Real Estate Asset Management Software

Related content