Real Estate Reporting Software: Portfolio Insights, Acquisition Visibility & AI-Driven Accuracy

Real Estate Reporting Software That Transforms Property Data Into Insights

Real estate reporting software aggregates data from property management systems, rent rolls, lease files, and accounting platforms into unified reports that operators, investors, and asset managers can use for decision-making. These platforms automate what traditionally required hours of spreadsheet work, income tracking, financial statements, and investor communications.

The challenge is that most property teams still rely on manual processes that break down at scale, creating delayed reports, data errors, and blind spots that erode NOI and compliance posture. This article covers what real estate reporting software does, why manual approaches fail, and how AI-powered platforms, now being piloted by 92% of CRE teams according to JLL, are transforming static reports into continuous portfolio intelligence.

What is real estate reporting software

Real estate reporting software pulls data from property management systems, rent rolls, lease files, and accounting platforms into unified reports that operators, investors, and asset managers can actually use. Top platforms in this space include AppFolio and Yardi for AI-driven portfolio management, while Stessa offers free, investor-focused financial tracking. The common thread is automation, income and expense tracking, profit-and-loss statements, and custom reports that would otherwise take hours to compile manually.

The core function is straightforward: connect to the systems where property data lives, aggregate that data, and present it in formats that support decision-making. Different roles pull different reports from the same underlying information.

- Operational tracking: Occupancy trends, delinquency rates, maintenance response times, and resident retention metrics

- Financial reporting: Income statements, cash flow summaries, and budget variance analysis

- Investor communications: Capital calls, distribution statements, and quarterly performance updates

- Compliance documentation: Audit trails, regulatory filings, and lease verification records

Property managers typically care about day-to-day operations. Asset managers focus on NOI and portfolio performance. Investors want transparency into returns. Reporting software serves all three audiences from a single data source.

Why manual reporting fails property teams

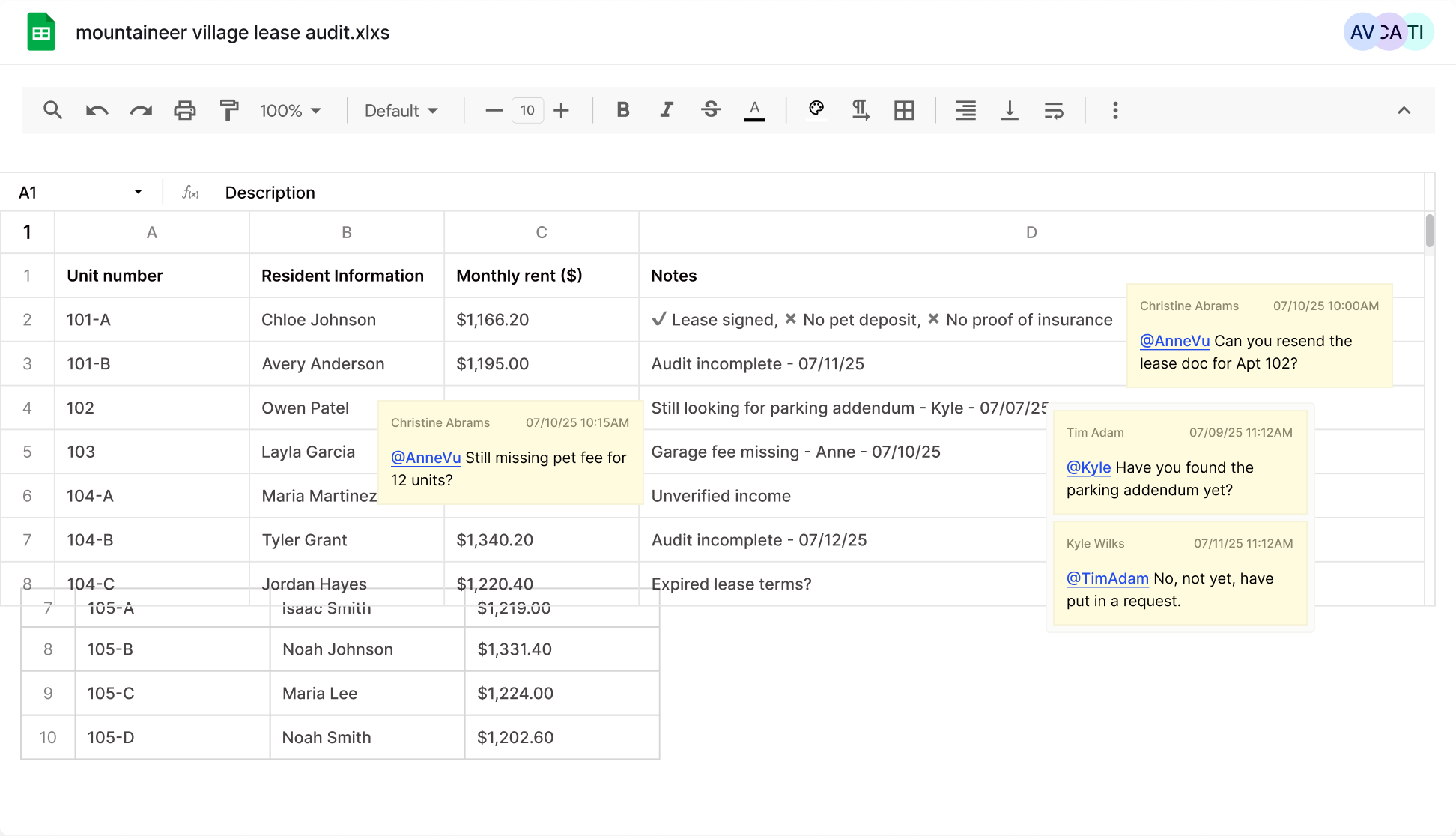

The traditional process looks familiar to anyone who has worked in property operations. Export data from the PMS. Pull numbers from accounting. Copy lease details from PDFs. Paste everything into a spreadsheet. Format it for presentation. Repeat monthly, quarterly, and annually, often with different people handling different steps.

This sequence breaks down in predictable ways. Version control becomes a problem when multiple people edit the same file. One incorrect entry in a rent roll cascades through every dependent calculation. By the time a report reaches decision-makers, the data may already be outdated.

The structural problems fall into four categories:

- Data silos: Information lives in separate PMS, accounting, and storage systems with no automatic connection between them – the dominant constraint limiting AI effectiveness across real estate, according to a 2026 CRETI analysis

- Time drain: Hours go toward compiling rather than analyzing, which means teams react to problems instead of preventing them

- Error propagation: Manual data entry introduces mistakes that are difficult to catch before reports are finalized

- Stale insights: Reports reflect yesterday’s data rather than current conditions

The financial impact adds up quickly. A missed charge on a single lease might seem minor, but multiply that across hundreds or thousands of units and the revenue leakage becomes material – industry estimates put annual losses at 3–7% of revenue for mid-to-large portfolios. Meanwhile, compliance documentation gaps create exposure during audits or disputes.

How AI transforms property data into actionable insights

Traditional reporting software waits for someone to request a report. AI-powered platforms work differently, they continuously monitor data and surface issues without being asked.

This distinction matters because many of the most valuable insights are buried in unstructured data. Lease PDFs, email threads, scanned addenda, and handwritten notes contain information that traditional reporting tools cannot read. AI can extract and interpret this information, then cross-reference it against structured data from rent rolls and accounting exports.

Platforms like SurfaceAI use AI agents to perform continuous oversight rather than periodic reviews. Instead of discovering a missing charge at month-end, the system flags it the moment a lease is updated.

The capabilities that enable this shift include:

- Automated extraction: AI reads lease documents and pulls key terms, dates, and amounts directly into the reporting system without manual data entry

- Pattern recognition: Algorithms identify trends and outliers across portfolio performance that would take humans hours to spot

- Continuous monitoring: Issues are flagged as they occur rather than waiting for the next scheduled audit

- Natural language queries: Teams can ask questions in plain English and receive contextual answers drawn from their own data

The result is a move from reactive reporting to proactive intelligence. Reports become a byproduct of continuous monitoring rather than a standalone exercise.

What Real Estate Reporting Software Is Designed to Solve

Reporting tools bring together data from multiple sources such as:

-

Property management systems

-

Leasing platforms

-

Accounting systems

-

Acquisition files

-

Lease documents

-

Rent rolls

-

Operational logs

The goal is to give asset managers, owners, and investors a clear view of:

-

Current performance

-

Forecasted risk

-

Lease exposure

-

NOI drivers

-

Variance trends

-

Acquisition readiness

-

Portfolio health

These insights guide billions in investment decisions and operational strategy.

Key capabilities of real estate reporting software

1. Automated report generation

Scheduled and on-demand report creation eliminates the manual compilation process. Reports pull live data from connected systems and format automatically according to predefined templates. What previously required hours of spreadsheet work can happen in minutes.

For example real estate acquisition tools help teams:

-

Analyze projected returns

-

Review rent rolls & ledgers

-

Model assumptions

-

Assess renewal exposure

-

Identify risks in target assets

For teams handling multifamily or commercial acquisitions, reporting accuracy directly impacts underwriting quality.

Related reading: AI Real Estate Deal Analyzer →

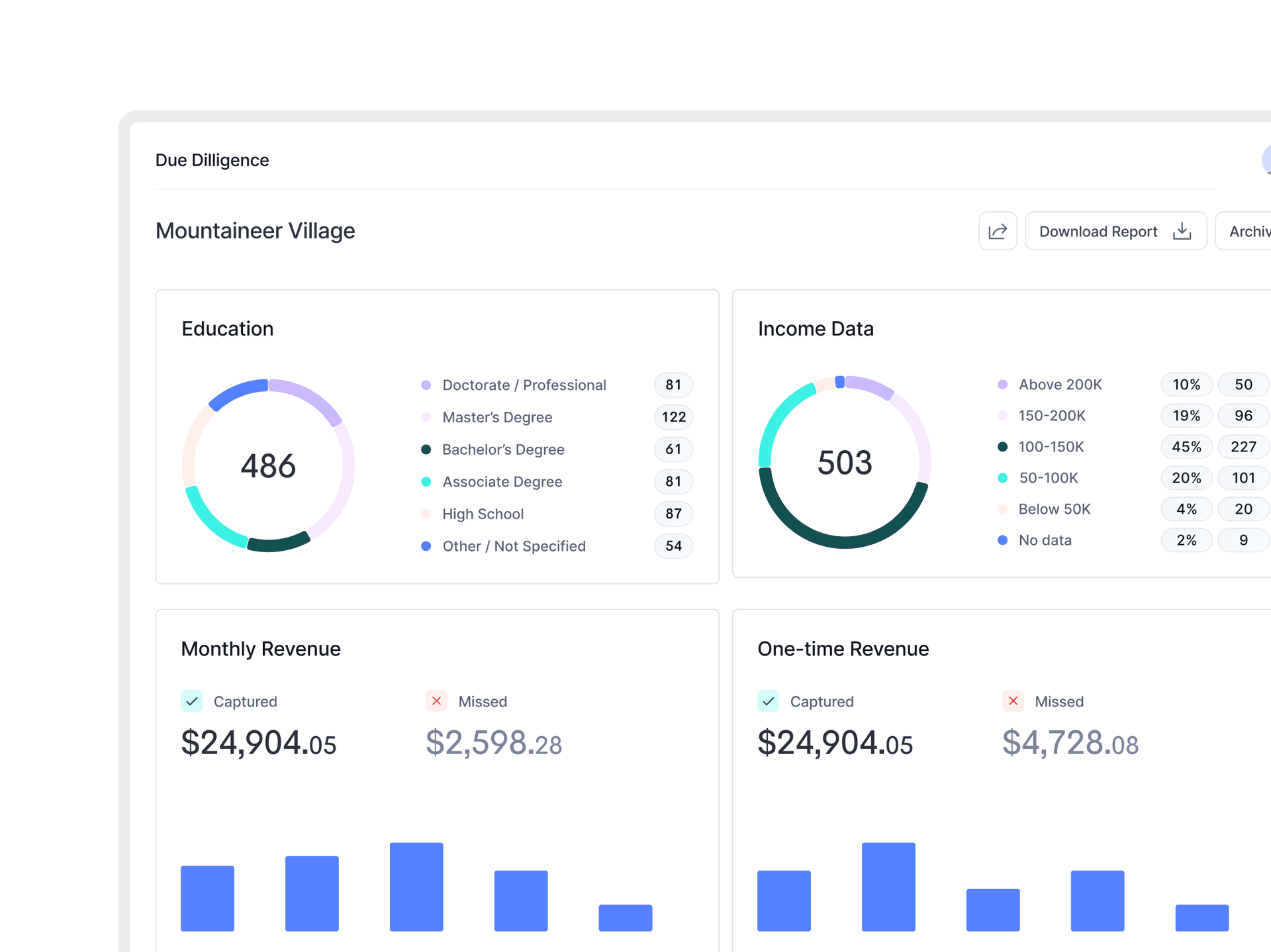

2. Real-time portfolio dashboards

Visual command centers display KPIs, alerts, and performance metrics that update continuously. Asset managers can see occupancy changes, delinquency spikes, or revenue anomalies as they happen rather than waiting for weekly or monthly summaries.

Reporting systems consolidate:

-

Occupancy & leasing trends

-

NOI & expense patterns

-

Rent collection performance

-

Rollover timing

-

Market benchmarks

-

Asset-level KPIs

These dashboards allow teams to compare assets, identify lagging units, and uncover operational improvements.

3. Customizable templates and branding

Investor reports, internal summaries, and board presentations often require different formats. Modern platforms allow teams to create templates that maintain consistent formatting while adapting content for different audiences.

4. Multi-source data unification

The most valuable reporting platforms connect to PMS, cloud storage, accounting systems, and document repositories to create a single source of truth. This eliminates the reconciliation work that eats up time before reports can even be generated.

5. Role-based access and permissions

Permission controls ensure investors see only their data, site teams see their properties, and corporate sees the full portfolio. This granularity is essential for maintaining confidentiality while still providing transparency to stakeholders who need it.

Types of reports real estate software can generate

Operational performance reports

Occupancy trends, leasing velocity, maintenance response times, and resident retention metrics all fall into this category.

Operations teams use these reports to identify properties that need attention and measure the effectiveness of process changes. Teams depend on real-time insight into:

-

Maintenance workloads

-

Turnover timelines

-

Delinquency

-

Vendor performance

-

Service level improvements

Related reading: Property Management Solutions →

Compliance and audit reports

Lease audit summaries, missing document flags, policy adherence tracking, and regulatory filing documentation create the audit trail that protects operators during disputes or regulatory reviews. Many reporting platforms now include views into:

-

Lease expirations

-

Rent escalations

-

Concessions

-

CAM allocations

-

Renewal risk

-

Contract obligations

These are essential for both operators and investors monitoring portfolio exposure.

SurfaceAI’s Lease Audit Agent, for example, runs continuously to catch errors and revenue leaks the moment they appear.

Due diligence and transaction reports

Pre-acquisition risk assessments, resident quality analysis, and revenue integrity verification help acquisition teams make informed decisions. SurfaceAI’s Due Diligence Agent automatically extracts and analyzes resident data to surface red flags before closing.

Financial and accounting reports

Reporting systems often integrate with accounting tools to help support ASC 842, IFRS 16, and internal controls. Income statements, balance sheets, budget variance analysis, and cash flow projections form the foundation of financial reporting. These reports feed investor communications and internal planning processes.

Eligibility, terms, options, and obligations must be accurately represented – otherwise downstream reports are compromised.

Real estate investor reporting software for LP communications

Capital call notices, distribution statements, quarterly performance updates, and K-1 allocation during tax season require specialized formatting and delivery. Real estate investor reporting software automates these communications to limited partners, reducing the administrative burden on internal teams while improving consistency.

How reporting software integrates with property management systems

Integration depth determines how useful reporting software actually is in practice. Surface-level integrations that only export data create additional reconciliation work. Deep integrations with bidirectional sync keep data consistent across systems without manual intervention.

| Integration Type | Examples | Data Flow |

|---|---|---|

| Property Management Systems | Yardi, RealPage, AppFolio, Entrata | Rent rolls, resident data, lease terms |

| Accounting Software | QuickBooks, Sage | Financial transactions, GL entries |

| Cloud Storage | OneDrive, SharePoint, Google Drive | Lease PDFs, addenda, notices |

| Communication Tools | Email, SMS platforms | Resident correspondence, notices |

SurfaceAI connects to the core systems and storage tools property teams already use, unifying data from every corner of operations, whether it’s a rent roll, a lease PDF, or an email thread.

Why Reporting in Real Estate Has Become More Complex

Several industry trends are increasing the pressure on reporting systems:

1. Larger, more distributed portfolios

Operators manage more assets across more markets each with different assumptions and obligations.

2. More intricate leases and financial structures

Performance reporting now depends on dozens of variables inside lease contracts, amendments, and addenda.

3. Stricter regulatory and accounting standards

Accurate reporting is an expectation, not an option.

4. Faster acquisition cycles

Teams need reports and due diligence insights earlier in the investment process.

5. Real-time operational expectations

Executives expect dashboards that update dynamically, not monthly or quarterly.

This is why reporting software has become foundational to modern operations and why AI is increasingly used to support data integrity.

As EY notes in its analysis of digital reporting modernization, real estate organizations are increasingly using AI to strengthen data integrity, reduce manual reporting delays, and improve transparency across portfolios.

(Reference: EY – Modernizing real estate reporting with AI →)

Where Traditional Reporting Ends And AI Accuracy Begins

Even the best reporting software depends on accurate source data.

But lease data is often inconsistent, incomplete, or misaligned across:

-

Lease agreements

-

Amendments

-

Ledgers

-

Rent rolls

-

PMS systems

-

Cloud folders

-

Diligence documents

This creates the industry’s biggest operational blind spot: inaccurate reporting caused by inaccurate contracts.

SurfaceAI closes this gap by ensuring the data flowing into reporting platforms is correct before it’s ever used.

How SurfaceAI Enhances Real Estate Reporting Systems

SurfaceAI acts as an intelligence layer, verifying accuracy across leases, ledgers, and supporting documents, feeding reliable data into any reporting or acquisition platform.

Lease Audit Agent

Automatically reviews leases to identify:

-

Incorrect rent schedules

-

Fee discrepancies

-

Missing terms

-

Concession issues

-

Ledger mismatches

-

Execution errors

Reporting is only reliable when lease terms are correct.

Learn more about the Lease Audit Agent →

“The audit program from SurfaceAI was a game-changer for us. This structure helped us identify and capitalize on missed opportunities for revenue, turning what was once a blind spot into a source of income.”

Glennette Calero, Property Manager

Document Management Agent

Ensures every lease and supporting document is organized, complete, and validated across the portfolio.

Missing or misfiled documents create major reporting issues, this agent prevents them.

Learn more about the Document Management Agent →

Due Diligence Agent

Accelerates acquisition reporting by processing large deal files and surfacing risks early.

This reduces underwriting delays and strengthens decision-making.

Learn more about the Due Diligence Agent →

Workspace: Real-Time Portfolio Intelligence

Workspace compiles findings across all agents into a single interface, giving reporting teams:

-

Verified lease data

-

Document completeness scores

-

Exception alerts

-

Ledger-to-lease comparisons

-

Portfolio-level trends

This enhances the accuracy of any reporting system already in place.

Benefits of automated real estate reporting

Significant time savings on report preparation

Teams redirect hours from compilation to analysis and action. A regional operator with 5,000 units might spend 40+ hours monthly on manual reporting. Automation can reduce this to a fraction of that time while improving accuracy.

Improved accuracy and reduced errors

Automated data pulls eliminate manual entry mistakes. Validation rules catch discrepancies before reports are finalized, reducing the risk of decisions based on incorrect information.

Faster decision-making with real-time data

Real-time financial monitoring enables proactive response to occupancy changes, delinquency spikes, or revenue anomalies. Asset managers can act on today’s data rather than last week’s snapshot.

Enhanced transparency with investors and stakeholders

Consistent, timely, branded reports build trust. Investors receive updates without manual effort from internal teams, and the documentation trail demonstrates professional management practices.

What to look for in real estate investor reporting software

Integration depth with core systems

Evaluate whether the platform connects to your existing PMS and storage without requiring data exports or middleware. The fewer manual steps between source data and final report, the more reliable the output.

Automation scope and flexibility

Assess what can be automated, report generation, distribution, alerts and whether workflows are customizable to match your specific processes and policies.

Analytics and anomaly detection

Look for platforms that go beyond static reports to actively flag issues, trends, and outliers requiring attention. This is where AI-powered solutions differentiate themselves from traditional reporting tools.

Security and permission controls

Confirm data encryption, SOC compliance, and granular access controls appropriate for investor-sensitive information. These protections are non-negotiable for institutional portfolios.

The Future of Real Estate Reporting

Industry research shows real estate teams are moving toward reporting ecosystems powered by:

-

AI-driven contract validation

-

Continuous lease auditing

-

Predictive exposure analysis

-

Automated document intelligence

-

Smart risk detection

-

Real-time acquisition insights

Industry research shows that real estate teams are evolving toward reporting ecosystems powered by continuous AI auditing, predictive insights, and automated document intelligence.

McKinsey highlights how generative and operational AI will reshape real estate data workflows, enabling faster decision-making and more accurate financial forecasting.

(Reference: McKinsey – Generative AI can change real estate, but the industry must change to reap the benefits)

SurfaceAI is already delivering many of these capabilities, strengthening the systems organizations rely on daily.

From property reports to portfolio intelligence

Modern platforms do more than generate reports, they provide a command center for monitoring, flagging, and acting on portfolio-wide data. The evolution from static reporting to continuous intelligence represents a fundamental shift in how operators manage their portfolios.

SurfaceAI’s Intelligent Workspace serves as this kind of operational hub, combining reporting with AI agents that automate workflows and surface insights without manual intervention. The Lease Audit Agent runs continuously, the Delinquency Agent automates rent collection follow-ups, and the Due Diligence Agent accelerates transaction analysis, all feeding into a unified view of portfolio performance.

The operators who gain competitive advantage are those who treat reporting not as a periodic obligation but as a continuous capability embedded in daily operations.

Book a demo to see how AI-powered reporting transforms property operations.

FAQs about real estate reporting software

Related content