Real Estate Due Diligence Software: How to Streamline Your Process

Due diligence on a multifamily acquisition can consume weeks of analyst time and still miss the unsigned lease or delinquent resident that erodes returns after closing. The gap between what manual reviews catch and what actually matters to NOI is where deals go sideways.

Real estate due diligence software automates the extraction and analysis of lease files, rent rolls, and resident data, compressing timelines from weeks to days while surfacing risks that spreadsheet-based audits routinely overlook. This guide covers what the software does, why traditional processes fail, and how to evaluate platforms that fit your acquisition workflow.

What Is Real Estate Due Diligence Software

Real estate due diligence software automates the review of property documents, lease files, and resident data during acquisitions or portfolio transitions. Rather than manually opening each lease PDF and cross-referencing it against a rent roll, acquisition teams use this software to ingest documents, extract key data points, and flag discrepancies automatically.

The people who rely on this software are typically acquisition teams, asset managers, and operators evaluating properties before closing a transaction. The core problem it solves is straightforward: compressing what used to take weeks of manual review into days or hours, while catching issues that human reviewers routinely miss.

At a functional level, due diligence software handles four tasks:

- Document ingestion: Pulls rent rolls, lease PDFs, and related records from property management systems and cloud storage without manual uploads

- Data extraction: Parses lease terms, rent amounts, resident names, and key dates from unstructured documents using AI

- Risk flagging: Identifies mismatches between documents, unsigned leases, delinquency patterns, and other anomalies

- Reporting: Generates standardized outputs that deal teams can review, share with investors, or present to deal committees

Why Traditional Due Diligence Processes Fall Short

Most acquisition teams still run due diligence the same way they did a decade ago: spreadsheets, manual file reviews, and a lot of copying and pasting. This approach worked when deal volume was lower and timelines were longer. Today, it creates bottlenecks that slow deals and introduce risk.

Manual Lease Reviews Create Bottlenecks

Consider a 200-unit acquisition. A single analyst reviewing lease files manually, checking signatures, comparing rent amounts to the rent roll, noting discrepancies, might spend 40 to 60 hours on that one deal. Multiply that across a pipeline of five or six active acquisitions, and the math stops working.

Manual reviews also fatigue reviewers. By the hundredth lease file, attention drifts. Details slip through. The unsigned addendum on unit 147 gets missed. The pet fee that was never added to the ledger goes unnoticed.

Fragmented Data Leads to Missed Red Flags

The information needed for due diligence rarely lives in one place. Rent rolls sit in the PMS. Lease PDFs are scattered across SharePoint folders. Payment history might be in a different export. Email threads contain context that never made it into formal documentation.

Without a unified view, connections stay invisible. A resident might appear current on the rent roll but have a pattern of late payments buried in transaction history. That pattern only becomes visible when someone consolidates the data, and in manual processes, that consolidation often happens too late or not at all.

Point-in-Time Audits Leave Gaps

Traditional audits capture a snapshot. The analyst reviews files on a Tuesday, generates a report, and moves on. But properties keep operating. New residents move in. Lease amendments get signed. Delinquencies emerge.

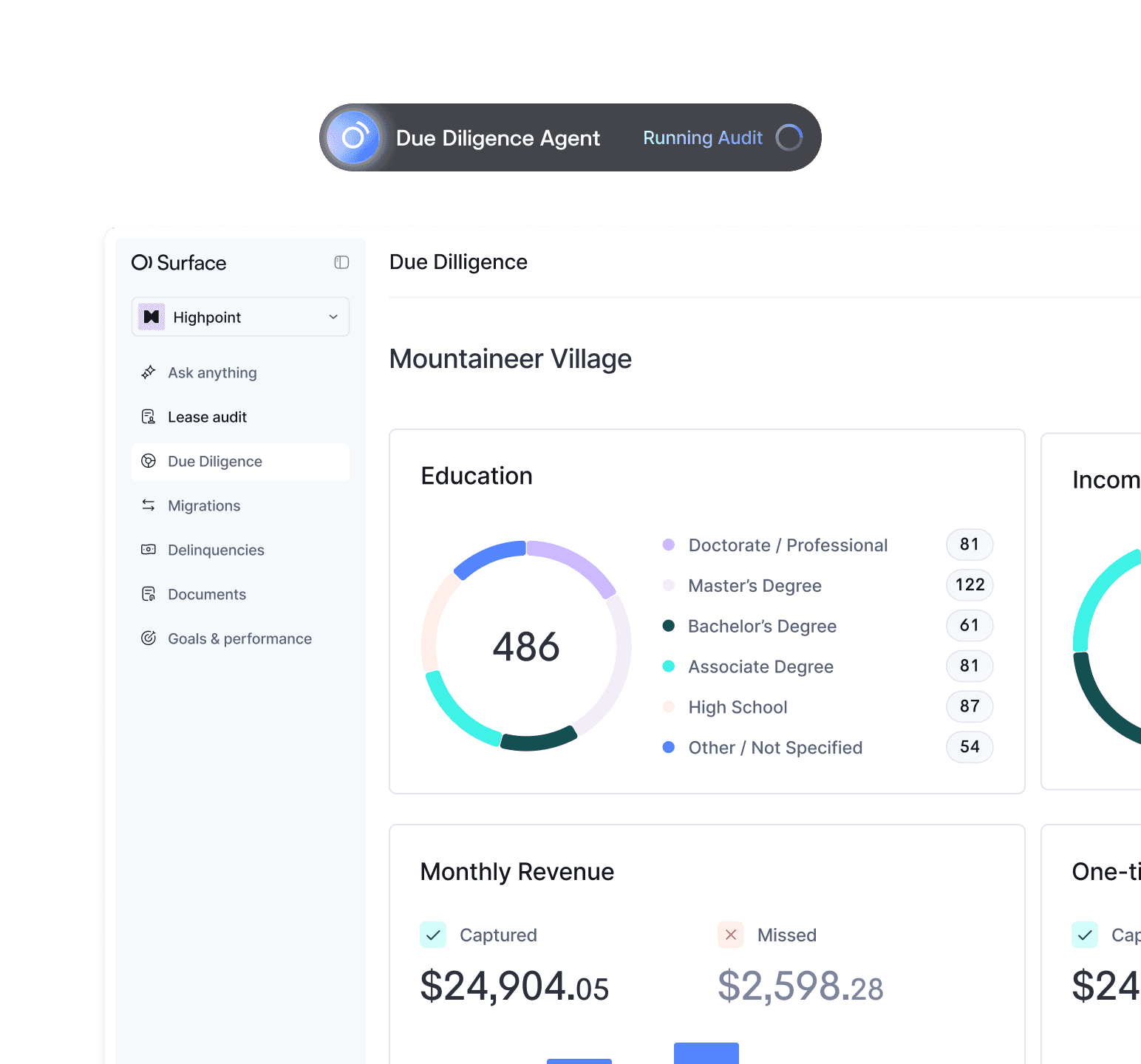

By the time the deal closes, the snapshot is stale. The risk profile has shifted, and the buyer inherits surprises that a continuous monitoring approach would have caught. This is why platforms designed for ongoing analysis – like SurfaceAI’s Due Diligence Agent – run in the background rather than producing a single static report.

Key Features of Due Diligence Management Software

Not all due diligence tools are created equal. Some are glorified file storage. Others offer genuine automation that changes how acquisition teams work. The features below separate purpose-built platforms from generic document management.

Automated Document Extraction and Analysis

AI-powered extraction pulls structured data from lease PDFs, rent rolls, and supporting documents without manual entry. The software reads a lease, identifies the rent amount, lease start date, resident name, and key terms, then populates a database that can be queried and analyzed.

This automation eliminates transcription errors and frees analysts to focus on interpretation rather than data entry. It also handles documents that vary in format, scanned leases, different PMS exports, inconsistent naming conventions – without breaking.

Risk Identification and Red Flag Detection

The software flags problems automatically rather than waiting for an analyst to spot them. Financial discrepancies, demographic risk factors, and compliance issues surface without manual hunting.

Common red flags include:

- Mismatched names or rent amounts between the rent roll and lease documents

- Unsigned or incomplete lease files

- Residents with prior evictions or bankruptcies

- Delinquency patterns that suggest collection risk

- Occupancy trends that deviate from market norms

Portfolio-Wide Reporting and Dashboards

Centralized reporting aggregates findings across all properties in a transaction. Deal teams see portfolio-level risk at a glance and drill into property-specific issues when needed.

Exportable reports support deal committees and investor presentations. Institutional buyers expect standardized documentation, and portfolio-wide dashboards deliver that without manual assembly.

Integration with Property Management Systems

Connectivity to existing PMS platforms Yardi, RealPage, Entrata, AppFolio and cloud storage like OneDrive and SharePoint determines how quickly a team can get value from the software. Without integrations, every deal starts with manual file uploads, which defeats the efficiency gains automation promises.

How Due Diligence Software Streamlines Real Estate Transactions

The workflow improvements from due diligence software are practical and measurable. The shift is from reactive auditing, reviewing files after they’re assembled, to proactive analysis that runs continuously.

Compressing Time from LOI to Insight

Automation shrinks review timelines dramatically. A 500-unit portfolio that might take two weeks to audit manually can be analyzed in 48 hours with the right platform.

This speed matters in competitive markets. When multiple buyers are pursuing the same asset, the team that can generate insights faster has an advantage. Faster diligence means more confident bidding and fewer deals lost to slower processes.

Unifying Data Across Systems and Storage

The software pulls data from rent rolls, lease PDFs, PMS exports, and email threads into a single workspace. Teams stop chasing documents across platforms and reconciling conflicting versions.

SurfaceAI’s Workspace, for example, serves as a command center where due diligence data lives alongside other operational agents. Everything needed for analysis is in one place, accessible to everyone who needs it.

Automating Resident and Lease Risk Profiling

Automated analysis of resident-level data, payment history, employment status, legal history, builds risk profiles that inform pricing and post-acquisition planning.

Rather than discovering a high-risk resident population after closing, teams can adjust their offer price or plan for increased collections effort before the deal is finalized. This is where the best tools for real estate investor due diligence tracking add value that manual processes cannot match.

Benefits of Automating Real Estate Due Diligence

The outcomes from automation extend beyond time savings. Deal velocity, revenue protection, and process consistency all improve in measurable ways.

Faster Deal Velocity Without Sacrificing Thoroughness

Automation allows teams to review more deals in less time while catching issues that manual reviews miss. The tradeoff between speed and thoroughness disappears when software handles the repetitive work.

Teams can pursue a larger pipeline without adding headcount. The constraint shifts from analyst capacity to deal sourcing.

Reduced Revenue Leakage and Post-Acquisition Surprises

60% of property managers face monthly financial discrepancies, and early detection of missed charges, incorrect rents, or risky residents prevents value erosion after closing. A single missed pet fee across 200 units at $50 per month represents $120,000 in annual revenue leakage, the kind of issue automated analysis catches before closing.

Every dollar of missed revenue identified pre-acquisition is a dollar that can be recovered or priced into the deal. This protection ties directly to NOI.

Consistent and Standardized Processes Across Deals

Software enforces a repeatable audit framework. Every acquisition follows the same checklist, the same risk criteria, and the same documentation standards.

This consistency matters for institutional investors who expect standardized reporting. It also reduces variability between analysts, the same issues get flagged regardless of who runs the analysis.

How to Evaluate Due Diligence Software for Real Estate Investors

Selecting the right platform requires evaluating several criteria. The questions below help distinguish tools that deliver real value from those that add complexity without improving outcomes.

Data Source Compatibility and Integrations

Confirm the platform connects to your existing PMS, cloud storage, and document repositories. Integration depth affects time-to-value. A platform that requires manual uploads for every deal adds friction that undermines efficiency gains.

Depth of Automated Analysis and Tracking

There’s a meaningful difference between document storage and AI-powered analysis. Evaluate whether the tool extracts data, flags risks automatically, and assigns follow-up tasks or whether it simply organizes files for manual review.

Scalability Across Portfolio Size

The software needs to handle portfolios of varying sizes without degraded performance. Ask whether pricing and functionality scale with unit count or deal volume, and whether the platform has been tested on portfolios similar to yours.

Vendor Support and Implementation Timeline

Evaluate the onboarding process, training resources, and ongoing support. Implementation speed matters for teams with active pipelines. A platform that takes months to deploy may miss the deals you’re working on now.

| Evaluation Criteria | Questions to Ask |

|---|---|

| Integrations | Does it connect to our PMS and cloud storage? |

| Analysis Depth | Does it extract data and flag risks automatically? |

| Scalability | Can it handle our portfolio size and deal volume? |

| Implementation | How long until we’re operational? |

| Support | What training and ongoing support is included? |

Due Diligence Platform Pricing Models

Due diligence platform pricing varies by vendor and typically follows one of several structures:

- Per-deal pricing: Charges based on each transaction or acquisition reviewed

- Per-unit pricing: Scales with the number of units in the portfolio being analyzed

- Subscription/platform fee: Flat monthly or annual fee for access to the platform and features

- Tiered pricing: Different feature sets or usage limits at different price points

Buyers benefit from clarifying what’s included – integrations, support, number of users, and watching for hidden fees that inflate total cost of ownership.

Turning Due Diligence into a Competitive Advantage

Due diligence doesn’t have to be a transactional chore. Teams using automated due diligence software for real estate can move faster, bid with more confidence, and avoid post-close surprises that erode returns.

CRE sales volume is projected to rise 15–20% in 2026, and operational efficiency in diligence becomes a clear differentiator. The teams that generate insights in hours rather than weeks have a structural advantage in competitive bidding situations.

According to McKinsey, 23% of organizations are scaling agentic AI systems across their enterprises. Platforms like SurfaceAI’s Due Diligence Agent run continuously in the background, surfacing insights without manual effort. Acquisition teams can focus on deal strategy rather than document review, knowing the analysis is happening automatically.

“The worst part of due diligence is doing the audits and SurfaceAI has taken that on”

Gary Robbins, Transitions Manager

FAQs About Real Estate Due Diligence Software

Related content