Multifamily Proptech Explained: Choosing the Right Technology Stack

Multifamily proptech refers to technology companies building software, IoT devices, and digital tools designed specifically for residential rental property operations, spanning everything from leasing and rent collection to maintenance and renewals. The category has expanded rapidly, with $16.7 billion invested in proptech globally in 2025 alone, but so has the complexity of choosing which tools to adopt and how to connect them.

Most operators now run five or more software platforms that don’t communicate well with each other, creating data silos, manual workarounds, and revenue leakage that erodes NOI. This guide breaks down the core technology categories, explains how AI is reshaping operations, and provides a framework for building and evaluating an integrated tech stack.

What Is Multifamily Proptech

Multifamily proptech refers to technology companies building software, IoT devices, and digital tools designed specifically for residential rental property operations. The category spans the full operational lifecycle, from marketing and leasing through rent collection, maintenance, and renewals, with the goal of reducing operational costs, enhancing resident experiences, and improving net operating income for owners.

The term “proptech” is short for property technology. When applied to multifamily, it distinguishes software built for apartment operations from tools designed for commercial real estate, single-family brokerage, or construction. A multifamily tech stack, then, is simply the combination of software tools an operator uses together to run their portfolio.

Most operators today rely on multiple proptech solutions that handle different functions:

- Leasing and marketing: Attracting prospects and converting them into signed leases

- Property management: Managing rent rolls, lease documents, and resident records

- Financial operations: Accounting, budgeting, and investor reporting

- Maintenance and facilities: Work orders, inspections, and vendor coordination

- Workflow automation: Reducing manual tasks across all of the above

The challenge isn’t finding software for each function. It’s getting all of them to work together without creating data silos, manual workarounds, or compliance gaps.

Core Categories of Multifamily Technology

A modern multifamily proptech stack typically includes five primary software categories. Understanding what each does, and where they overlap, helps operators make smarter decisions about which tools to adopt and how to connect them.

Property Management Software

The property management system, or PMS, serves as the system of record for rent rolls, leases, and resident data. Think of it as the operational backbone of any multifamily portfolio. Every other tool in the stack typically connects to the PMS to pull or push information.

Common PMS platforms include Yardi, RealPage, AppFolio, Entrata, and ResMan. The PMS handles core functions like lease tracking, rent ledgers, and resident communication, though it rarely excels at every workflow. That’s why operators layer additional tools on top.

Leasing and Marketing Technology

This category covers CRM systems, internet listing service syndication, virtual tour platforms, and AI chatbots for prospect engagement. The focus is on the prospect-to-lease conversion workflow, getting someone from an online search to a signed lease as efficiently as possible.

Leasing technology has evolved rapidly over the past few years. AI-powered chatbots now handle initial prospect inquiries, schedule tours, and answer questions about availability and pricing around the clock.

Asset and Portfolio Management Software

Asset managers and investment teams use portfolio management tools to track performance, benchmark properties against peers, and report to investors. The emphasis here is portfolio-level visibility rather than day-to-day site operations.

The data often comes from the PMS, but asset management software aggregates and analyzes it across properties to surface trends, risks, and opportunities that aren’t visible at the individual site level.

Financial and Reporting Technology

Accounting platforms, budgeting tools, and financial analytics support month-end close and investor reporting. While the PMS handles basic accounting, many operators use specialized financial software for more sophisticated budgeting, forecasting, and variance analysis.

Workflow Automation and Operations Technology

Workflow automation refers to software that executes repetitive operational tasks, such as delinquency follow-ups, lease audits, and document management, without manual intervention. This is the fastest-evolving category in multifamily proptech, driven largely by advances in AI.

| Category | Primary Users | Core Function |

|---|---|---|

| Property Management Software | Site teams, property managers | System of record for leases and residents |

| Leasing and Marketing Technology | Leasing agents, marketing teams | Prospect engagement and conversion |

| Asset and Portfolio Management | Asset managers, investment teams | Portfolio performance and reporting |

| Financial and Reporting Technology | Accounting, finance teams | Budgeting, accounting, and close |

| Workflow Automation and Operations | Operations, regional teams | Automating repetitive tasks |

Common Challenges with Multifamily Software Stacks

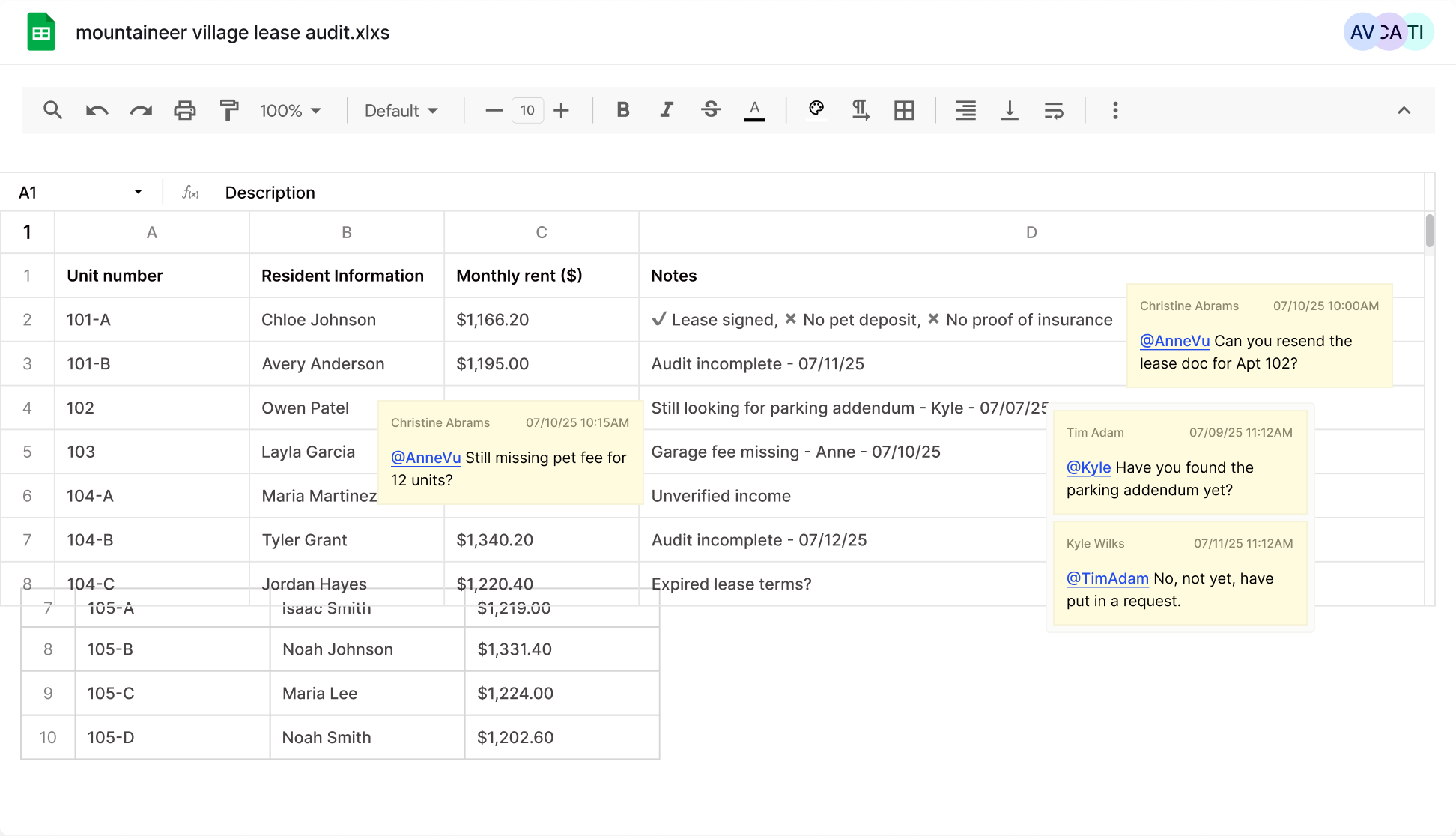

Operators have adopted multiple point solutions over the years, often selecting the “best of breed” tool for each function. The unintended consequence is a fragmented technology environment where data doesn’t flow between systems, manual workarounds become the norm, and small errors compound into significant NOI and compliance risks.

Data Silos Across Properties and Systems

Information trapped in separate tools, the PMS, spreadsheets, cloud storage, email threads – creates blind spots. Across industries, 68% of organizations cite data silos as their top data management concern, and multifamily operations are no exception. A regional manager might not know that a property has unsigned lease addendums sitting in a SharePoint folder, or that a concession expired three months ago but the charge was never added back.

Without unified data, operators can’t see the full picture without manually pulling reports from multiple sources and reconciling them in spreadsheets. That reconciliation work takes time, and the gaps it misses cost money.

Manual Workflows That Cause Revenue Leakage

Errors in lease charges, missed concession expirations, and incomplete documentation often go undetected when audits rely on periodic spreadsheet reviews and spot checks. Industry practitioners commonly estimate that lease audit errors can cost operators 1–3% of gross potential rent annually, a figure that adds up quickly across a large portfolio.

Consider a 5,000-unit portfolio at $1,500 average rent. Losing just 1% to missed charges represents $900,000 in annual revenue leakage. That’s money left on the table because no one caught the error in time.

Integration Failures Between Point Solutions

Even when operators select tools that claim to integrate, the reality is often disappointing. APIs may sync data once per day rather than in real time. Field mappings may not align. Duplicate records may proliferate across systems.

The result is that staff spend hours reconciling data between systems instead of focusing on leasing, resident retention, or other revenue-generating activities.

Limited Actionable Insights from Operational Data

Having data and being able to act on it are two different things. Information may exist in the PMS or buried in lease documents, but it isn’t surfaced to the right person at the right time.

A property manager might not know that a resident has been late on rent three months in a row until the situation escalates. An asset manager might not see that a property’s concession policy is out of compliance until month-end reporting. By then, the damage is done.

The Role of AI in Multifamily Technology

AI in multifamily falls into two broad categories, and the distinction matters for operators evaluating technology.

- Resident-facing AI: Chatbots that answer prospect questions, schedule tours, and handle routine resident inquiries. The goal is improved responsiveness and reduced burden on leasing staff.

- Operational AI: Tools that analyze unstructured data, lease PDFs, rent rolls, email threads, to surface issues humans would miss. This includes lease audits, due diligence analysis, and document management workflow automation.

Operational AI is particularly valuable because it can process information that doesn’t fit neatly into structured database fields. A lease PDF contains terms, signatures, and addendums that a PMS may not fully capture. An email thread contains context about a resident dispute that never made it into the official record.

AI that can read, interpret, and act on unstructured data represents a significant leap beyond traditional property management software. It’s not just about storing information, it’s about understanding what the information means and flagging when something is wrong.

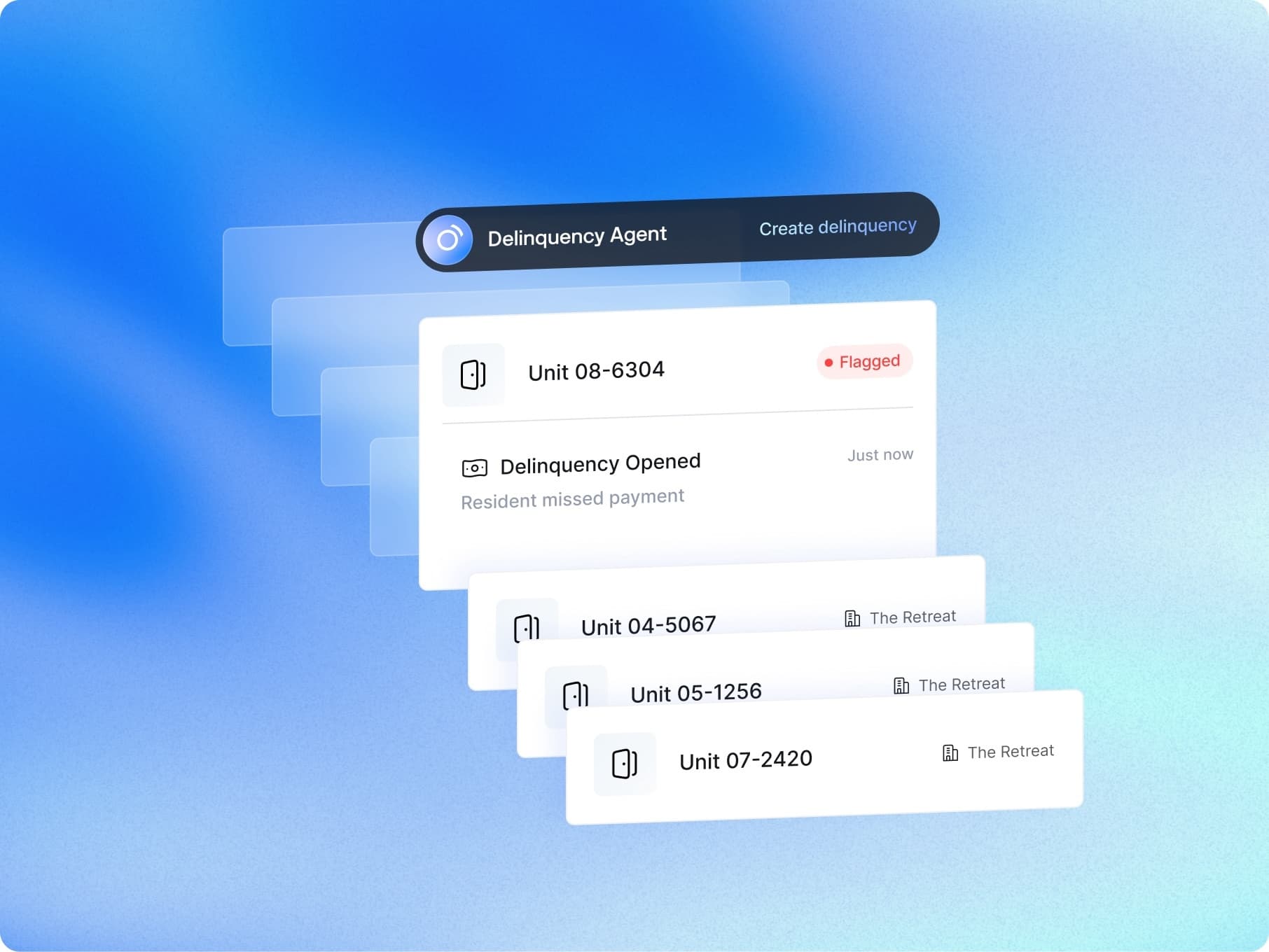

How AI Agents Differ from Traditional Automation

The term “AI agent” refers to autonomous digital workers that take action on behalf of operators, not just respond to queries. This is a meaningful distinction from both rule-based automation and chatbots.

- Rule-based automation: Executes predefined steps when triggered. If rent is late, send a notice. No judgment, no adaptation, no ability to handle exceptions.

- Chatbots: Respond to user questions through a conversational interface. Someone has to initiate the conversation and ask the right question.

- AI agents: Monitor data continuously, detect anomalies, and take action autonomously. They don’t wait for someone to ask, they surface issues proactively and assign tasks to staff.

The framing “AI that acts, not just chats” captures this difference well. An AI agent running lease audits doesn’t wait for a property manager to request a report. It monitors every lease change, flags discrepancies as they occur, and creates tasks for staff to resolve issues before month-end.

Tip: When evaluating AI tools, ask whether the system requires manual initiation or operates continuously in the background. The difference determines whether you’re adding another tool to check or gaining a digital teammate that works around the clock.

How to Build an Integrated Multifamily Proptech Stack

Building an effective tech stack isn’t just about selecting individual tools. Integration and data unification are equally important, perhaps more so. A collection of excellent point solutions that don’t communicate creates more problems than it solves.

Establish the Property Management System as the Foundation

The PMS serves as the single source of truth for resident and lease data. All other tools in the stack connect to and sync with the PMS to avoid duplicate records and data drift.

Before adding new technology, operators benefit from ensuring their PMS data is clean and that integration pathways exist for the tools they plan to adopt. Starting with a messy foundation makes everything harder downstream.

Layer Automation for High-Impact Operational Workflows

Not all workflows benefit equally from automation. The highest-impact opportunities typically include:

- Lease audits: Catching missed charges, unsigned documents, and out-of-policy terms before they impact NOI

- Delinquency follow-ups: Ensuring consistent, compliant communication without manual chasing

- Due diligence during acquisitions: Extracting and analyzing resident data to surface red flags pre-close

- Document management during transitions: Getting lease files into the PMS without weeks of manual review

SurfaceAI offers AI agents designed for each of these workflows, operating continuously rather than waiting for periodic manual reviews.

“I’ve been thoroughly impressed with the Surface AI lease audit product. It’s exceptionally user-friendly, and the audit results are clear, concise, and easy to interpret. The impact on our student teams has been tremendous—what once took several days can now be completed in just a few hours. The tool also makes it simple to identify and address issues efficiently. I can’t speak highly enough about the value this product brings.”

Amanda Pour, Operations Compliance Manager

Unify Data Across Systems and Cloud Storage

Connecting the PMS alone isn’t enough. Operational data lives in cloud storage (SharePoint, OneDrive), email threads, and other repositories that traditional integrations don’t reach.

Unifying data across sources enables AI to compare what’s in the PMS against what’s in the actual lease document, for example, or surface context from email threads that explains a resident dispute. Without that unification, operators are working with an incomplete picture.

Add a Centralized Monitoring and Command Layer

An operational command center provides a single hub where teams can monitor agent activity, see flagged issues, and take action across a portfolio. Rather than logging into multiple systems and reconciling reports, operators can see what’s happening, what’s urgent, and what’s already been handled.

SurfaceAI’s Intelligent Workspace serves this function, coordinating AI agents and providing natural-language answers grounded in the operator’s own data.

How to Evaluate Multifamily Proptech Solutions

Vendor selection in multifamily proptech often focuses on feature checklists and demo impressions. A more practical approach evaluates tools based on how they’ll actually perform in your environment.

Assess Integration with Existing Systems

Confirm the solution connects to your PMS, cloud storage, and other core systems. Ask vendors specific questions: What APIs are available? How frequently does data sync? How are fields mapped between systems?

A tool that doesn’t integrate cleanly creates more work, not less.

Measure Operational ROI and NOI Impact

Evaluate tools based on revenue recovery, time savings for staff, and compliance risk reduction, not just license cost. A lease audit tool that recovers $50,000 in missed charges annually delivers clear ROI even if the subscription fee seems high in isolation.

Evaluate Vendor Support and Implementation Record

Ask about onboarding timelines, dedicated customer success resources, training materials, and references from similar-sized portfolios. Implementation quality often determines whether a tool delivers on its promise.

Test Scalability Across Your Portfolio

Confirm the solution can scale from a handful of properties to hundreds without performance degradation or per-unit pricing that becomes prohibitive at scale. What works for 10 properties may not work for 100.

Turning Multifamily Technology into Operational Advantage

The shift from reactive operations, fixing problems after they occur, to proactive operations, catching issues before they impact NOI – represents the core value proposition of modern multifamily proptech.

The right technology stack doesn’t just digitize existing workflows. It transforms how teams operate, surfacing issues earlier, automating repetitive tasks, and freeing staff to focus on leasing, retention, and resident experience. According to McKinsey, real estate companies leveraging AI have achieved over 10% gains in NOI through more efficient operating models and stronger retention.

Operators exploring AI agents for lease audits, due diligence, or delinquency workflows can book a demo with SurfaceAI to see how continuous automation compares to periodic manual reviews.

FAQs About Multifamily Proptech

Related content