AI Real Estate Deal Analyzer: Intelligent Tools for Property Investors

Real estate deal analysis has traditionally meant spreadsheets, manual data entry, and hoping nothing slips through the cracks before closing. For acquisition teams reviewing hundreds of units under tight timelines, that approach creates real exposure, missed revenue, undisclosed concessions, and resident risk factors that surface only after the wire transfer clears.

AI deal analyzers change the equation by automating data extraction from rent rolls and lease documents, flagging financial and compliance red flags, and compressing due diligence from days to hours. This article covers how these tools work, what features matter most, and how investors and underwriting teams can use AI to make faster, more confident acquisition decisions.

What Is an AI Real Estate Deal Analyzer

An AI real estate deal analyzer is software that uses machine learning to evaluate investment properties by automatically extracting and analyzing data from rent rolls, leases, and financial documents. Rather than requiring manual data entry into spreadsheets, AI deal analyzers ingest unstructured files, scanned PDFs, lease addenda, email attachments, and pull out the numbers and terms that matter for underwriting decisions.

The distinction from traditional analysis tools is significant. Basic deal calculators ask you to type in rent amounts, expenses, and assumptions. AI deal analyzers read the source documents themselves, cross-reference the data, and flag inconsistencies before you even know to look for them.

For investors and underwriting teams working under tight timelines, manual deal analysis introduces real risk. Errors slip through. Discrepancies between rent rolls and lease terms go unnoticed. Unsigned documents surface after closing. Each of these issues affects net operating income or creates compliance exposure that becomes expensive to resolve.

AI deal analyzers typically deliver three core capabilities:

- Data extraction: Automatically pulls figures from PDFs, rent rolls, and lease documents using optical character recognition and document parsing

- Risk detection: Flags financial anomalies, resident risk factors, and compliance gaps based on configurable rules

- Workflow automation: Routes findings to team members for action rather than generating static reports

See how automation improves evaluation speed in Property Management Workflow Automation →

The Next Generation of Real Estate Deal Analysis

Deal analysis has always been the backbone of real estate investing but spreadsheets and manual underwriting no longer scale.

Modern investors need AI-powered tools that process thousands of data points instantly, revealing insights traditional models can’t see.

That’s where AI real estate deal analyzers come in.

They merge machine learning, document intelligence, and automation to:

-

Underwrite assets faster and more accurately.

-

Identify hidden risks across rent rolls and leases.

-

Benchmark property performance in real time.

How AI Enhances Real Estate Underwriting

AI transforms underwriting by automating the most time-consuming steps:

| Workflow | Traditional Process | With AI |

|---|---|---|

| Lease Review | Manual reading of PDFs and rent rolls | SurfaceAI Due Diligence Agent scans thousands instantly |

| Risk Identification | Spreadsheet-based assumptions | AI flags missing clauses, unusual concessions |

| Revenue Forecasting | Static formulas | Predictive modeling learns from market data |

| Validation | Cross-checking by analysts | AI auto-verifies data against source documents |

These efficiencies allow acquisition teams to focus on strategy instead of document management.

Why Investors and Underwriting Teams Need AI for Deal Analysis

The pace of real estate transactions has changed. CBRE forecasts CRE investment activity to reach $562 billion in 2026, and buyers who move slowly lose deals. Meanwhile, portfolios have grown larger, and the cost of discovering problems after closing has increased. AI addresses all three pressures simultaneously.

Compressed Timelines from LOI to Close

Deal velocity has accelerated across most markets. When a letter of intent is signed, the clock starts ticking. Manual lease-by-lease review cannot keep pace when hundreds of units require analysis within days, a constraint driving the shift toward automated due diligence across multifamily acquisitions.

AI compresses the timeline from days of manual work to hours of automated processing. Teams review flagged exceptions rather than reading every document, which means faster decisions without sacrificing thoroughness. The difference between closing in two weeks versus four weeks often determines whether you win the deal at all.

Reduced Manual Error and Revenue Leakage

Spreadsheet-based audits miss things. Rent amounts that do not match lease terms. Charges that were never applied. Concessions that exceed what was disclosed. Under time pressure, even experienced analysts overlook discrepancies that AI catches consistently.

Revenue leakage from billing errors and missed charges can reach 1-3% of gross potential rent in portfolios without systematic audit processes, according to industry benchmarks from the National Apartment Association. On a 500-unit property at $1,500 average rent, that translates to $90,000-$270,000 in annual revenue at risk.

Scalable Due Diligence Across Large Portfolios

A 50-unit acquisition might be manageable with manual review. A 500-unit portfolio acquisition is not. AI enables consistent analysis across hundreds or thousands of units without proportional increases in staff time or audit costs.

The alternative, hiring temporary staff or accepting less thorough review, introduces risk that compounds as portfolios expand. Operators pursuing growth strategies find that manual processes become the bottleneck.

How AI Analyzes Real Estate Deals

Understanding what happens under the hood helps teams evaluate tools and set realistic expectations. AI deal analysis follows a structured process from data ingestion through insight delivery.

Automated Data Extraction from Rent Rolls and Leases

The process begins with ingestion. AI systems accept structured data like rent roll exports alongside unstructured documents, lease PDFs, addenda, notices, and supporting files. Optical character recognition (OCR) converts scanned documents into machine-readable text. Document parsing then identifies key fields: resident names, unit numbers, rent amounts, lease dates, and charge codes.

This extraction step eliminates the most time-consuming part of manual analysis. Instead of opening each file, finding the relevant information, and entering it into a spreadsheet, lease automation technology handles extraction automatically.

Financial and Demographic Red Flag Detection

Once data is extracted, AI applies rules and pattern recognition to identify anomalies. The specific flags depend on configuration, but common examples include:

- Rent amounts that do not match lease terms

- Residents with prior evictions or bankruptcies

- Unsigned or missing lease documents

- Out-of-policy concessions or lease terms

- Payment history indicating delinquency risk

- Occupancy patterns that suggest fraud or misrepresentation

Red flag detection surfaces issues that would otherwise require line-by-line comparison across multiple documents. Under typical deal timelines, that level of manual scrutiny rarely happens.

Workflow Automation from Insight to Task Assignment

Modern AI deal analyzers do more than generate reports. They assign tasks to staff, trigger follow-ups, and integrate into operational workflows. A flagged discrepancy becomes an assigned task with a deadline, not a line item in a PDF that someone might review later.

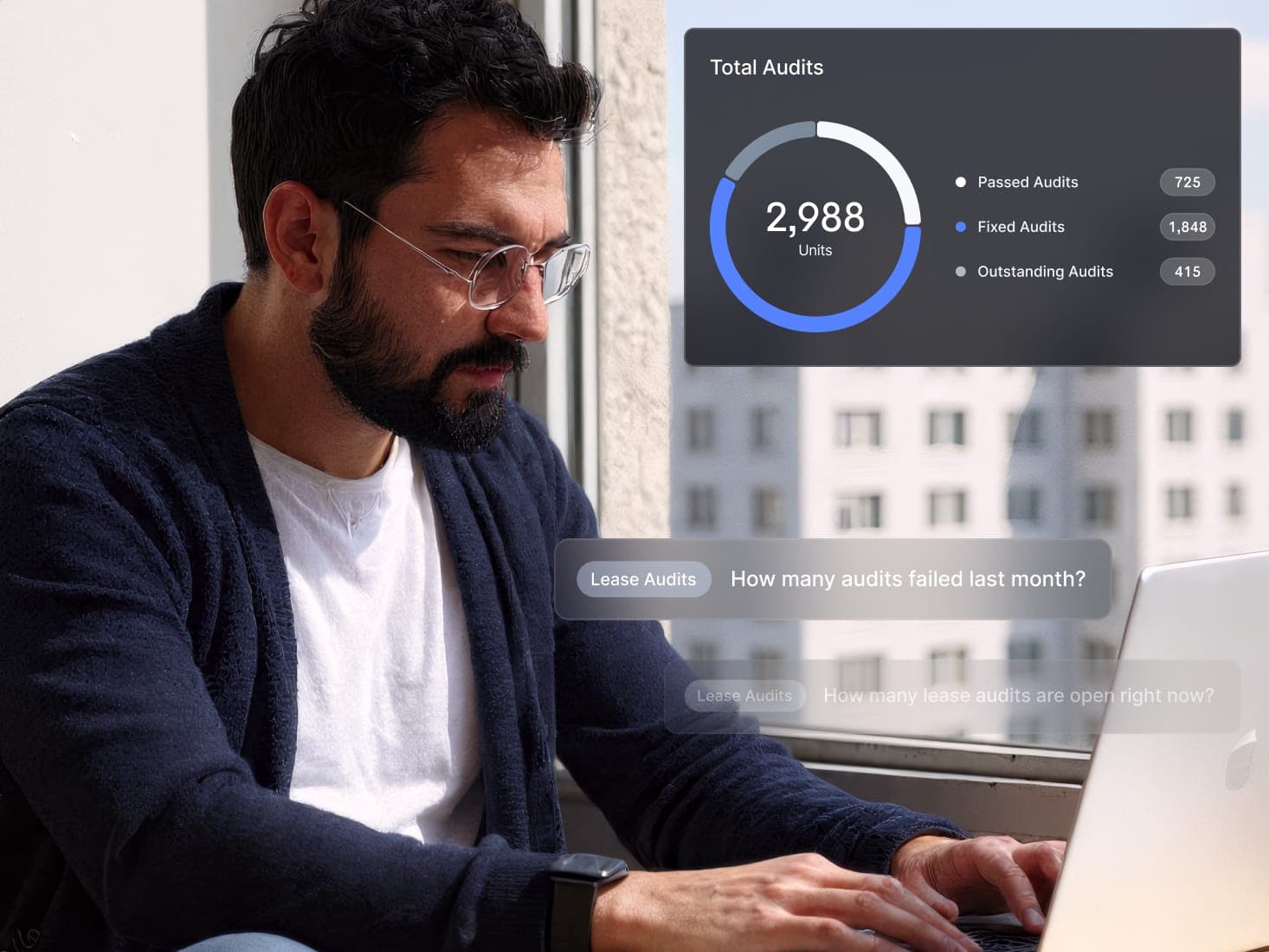

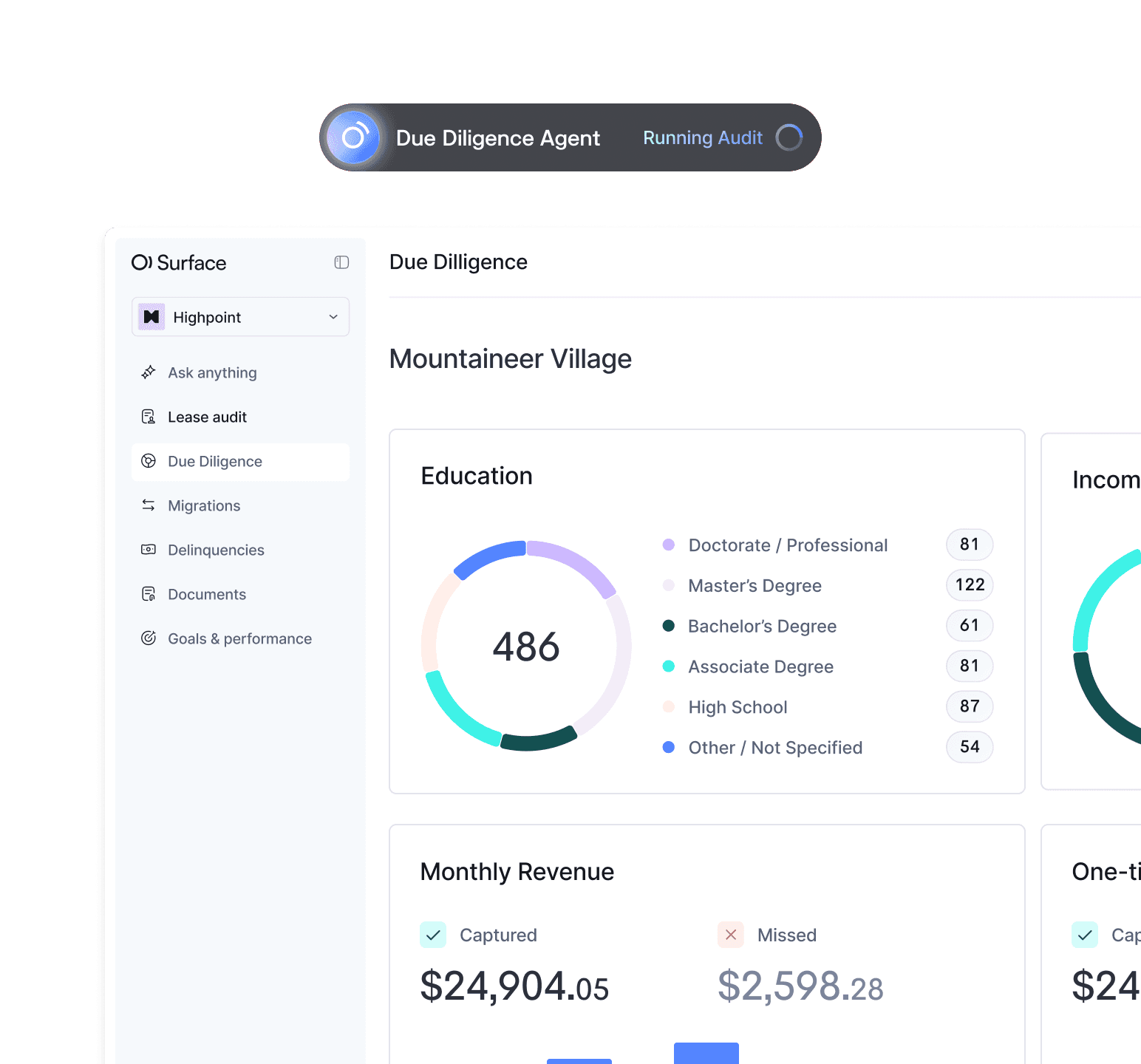

SurfaceAI’s Due Diligence Agent, for example, routes exceptions directly to team members within the same workspace where they manage other property operations. The finding and the action happen in one place.

Key Features to Look for in a Real Estate Deal Analyzer

Not all deal analyzers offer the same capabilities. Basic tools provide calculators for ROI and cash flow. Enterprise platforms automate extraction, flag risks, and connect to operational systems. The difference matters when evaluating which tool fits your workflow.

| Feature | Basic Deal Analyzer | AI-Powered Deal Analyzer |

|---|---|---|

| Data input | Manual entry | Automated extraction |

| Analysis type | Static calculations | Continuous monitoring |

| Risk detection | User-defined only | AI-flagged anomalies |

| Workflow integration | Export to spreadsheet | Task assignment and PMS sync |

Continuous Monitoring vs One-Time Analysis

Most deal analyzers run once and produce a static output. Advanced tools audit continuously as data changes. This distinction matters because deal data evolves, sellers provide updated rent rolls, new leases get signed during due diligence, and corrections arrive throughout the process.

Continuous monitoring catches changes that one-time analysis misses. It also extends value beyond acquisition into ongoing operations, where lease discrepancies and compliance gaps continue to emerge.

Resident-Level Risk Assessment

Financial analysis alone does not capture the full picture. Resident-level risk assessment examines demographic and behavioral signals, employment status, payment history, prior evictions, bankruptcy records, that indicate future performance.

A property might show strong current collections while harboring residents with deteriorating credit or employment situations. AI surfaces resident-level risks before they become collection problems.

Integration with PMS and Cloud Storage

The most useful deal analyzers connect directly to property management systems like Yardi, RealPage, and AppFolio, as well as cloud storage platforms like OneDrive and SharePoint. Direct integration eliminates manual uploads and ensures analysis reflects current system records.

Without integration, teams spend hours preparing data for analysis, time that could go toward reviewing findings and making decisions.

Permission-Aware Access and Data Security

Lease and resident data is sensitive. Reputable AI platforms use encryption, role-based permissions, and audit trails to protect information. Before adopting any platform, teams benefit from verifying SOC 2 compliance or equivalent security certifications.

SurfaceAI: The Automation Layer for Real Estate Investors

While many AI deal analyzer tools visualize data, SurfaceAI goes deeper, it automates the inputs themselves.

-

Due Diligence Agent: Reviews leases and rent rolls automatically, identifying inconsistencies and risk factors.

-

Lease Audit Agent: Runs continuous checks across owned portfolios post-acquisition.

-

Delinquency Agent: Tracks payments and anomalies to protect NOI.

SurfaceAI acts as the connective tissue between your existing underwriting models and your raw data, feeding clean, verified information directly into your deal models.

Learn more about the platform in Real Estate AI →

AI Deal Analysis for Multifamily and Commercial Real Estate Portfolios

AI deal analysis applies across asset classes, though the specific applications vary. Multifamily portfolios benefit most from resident-level analysis, unit-by-unit rent roll accuracy, individual lease term verification, and demographic risk assessment across potentially thousands of residents.

Commercial real estate deal analysis focuses more on lease abstraction and tenant creditworthiness. The document complexity differs, but the underlying value proposition remains: automated extraction and risk detection that manual processes cannot match at scale.

For multifamily operators specifically, the volume of leases and the granularity of resident data make AI particularly valuable. According to Yardi Matrix, multifamily volume reached $83.2 billion in 2025, and a single 300-unit property might have 300 active leases, each with multiple documents, addenda, and payment histories. Manual review of that volume is impractical under typical multifamily deal timelines.

Explore more applications in AI in Property Management →

Real-World Applications of AI Deal Analyzers

Understanding where AI fits into existing workflows helps teams plan implementation and set expectations.

Acquisition Due Diligence and Pre-Close Risk Review

Acquisition teams use financial due diligence tools powered by AI to validate seller-provided data, surface discrepancies, and identify hidden revenue leakage before closing. The goal is confidence that the numbers supporting the purchase price are accurate.

Common findings include rent amounts that do not match lease terms, charges that were never applied, and concessions that exceed what was disclosed. Each finding represents either recovered value or avoided overpayment.

Property Takeovers and Transition Audits

New management inheriting a property often faces messy files, incomplete documentation, and unclear resident status. AI provides instant visibility into lease accuracy and resident risk without weeks of manual file review.

Transition audits are especially valuable for third-party managers taking over distressed assets or portfolios from underperforming operators. The faster you understand what you have inherited, the faster you can address problems.

Ongoing Lease Audit and Compliance Monitoring

AI deal analysis does not stop at close. The same capabilities that support acquisition due diligence extend into ongoing operations, continuous monitoring for lease discrepancies, compliance gaps, and revenue leakage.

SurfaceAI’s Lease Audit Agent runs continuously rather than as a one-time review, catching issues the moment they appear rather than during periodic audits.

Best Practices to Maximize AI Deal Analysis Results

Adopting AI deal analysis requires some preparation to achieve full value. Teams that follow a few key practices see faster implementation and better outcomes.

1. Centralize Data Before Running Analysis

AI performs best when rent rolls, leases, and supporting documents are consolidated in connected storage or property management systems. Scattered files across email attachments, local drives, and disconnected folders slow analysis and increase the chance of missing documents.

2. Define Red Flag Thresholds Aligned to Investment Criteria

Not every anomaly matters equally. Teams benefit from configuring what constitutes a flag, delinquency over a certain number of days, concessions exceeding policy limits, specific resident risk factors, based on investment criteria and risk tolerance.

3. Connect AI Insights to Operational Workflows

Analysis without action is wasted effort. The most effective implementations connect AI findings directly to task assignment and resolution tracking. Flagged issues become assigned work items with owners and deadlines, not just report line items.

Smarter Deal Analysis Starts with the Right AI Platform

AI deal analyzers have moved from novelty to necessity for competitive investors and underwriting teams. According to JLL’s 2026 Global Real Estate Outlook, 88% of investors initiated AI programs in 2025, yet only 5% report achieving most of their goals, underscoring the gap between adoption and effective implementation. The volume of data, the pace of transactions, and the cost of missed issues all favor automation over manual review.

The right platform combines automated extraction, continuous monitoring, and workflow integration. It connects to existing systems, flags risks based on configurable criteria, and routes findings to the people who can act on them.

For multifamily operators and acquisition teams, the question is no longer whether to adopt AI deal analysis, but which platform delivers the capabilities that match their workflow and scale.

Book a demo to see how SurfaceAI’s Due Diligence Agent automates deal analysis for multifamily investors.

FAQs about AI Real Estate Deal Analyzers

Related content