AI for Real Estate: How Artificial Intelligence Is Transforming Investment Analysis, Operations, and Decision-Making

AI in real estate is no longer limited to chatbots and property valuations. The technology is now embedded in the operational workflows that determine whether portfolios protect revenue, maintain compliance, and scale without adding headcount.

This article examines how AI is reshaping property operations, from continuous lease auditing and automated delinquency management to document migration and due diligence, and what distinguishes AI agents from the tools that came before them.

What is AI in real estate

AI in real estate uses machine learning, natural language processing, and predictive analytics to automate tasks that once required human judgment. The most visible applications include Zillow’s Zestimate for instant property valuations, virtual staging tools that enhance listing photos, and chatbots that field prospect inquiries around the clock. According to Morgan Stanley, AI can automate up to 37 percent of tasks in real estate, representing $34 billion in potential operating efficiencies.

But here’s what most coverage misses: the bigger shift is happening in back-office operations, not consumer-facing tools. Property operators are now deploying AI to audit leases, automate rent collection notices, classify documents during acquisitions, and monitor portfolio performance continuously. This operational layer of AI doesn’t wait for someone to ask a question. It works in the background, flagging problems before they hit the P&L.

A few terms help clarify what’s actually happening:

- Machine learning: Algorithms that spot patterns in historical data, like payment behavior or lease term anomalies, to make predictions

- Natural language processing (NLP): Technology that reads unstructured text, allowing AI to extract terms from lease PDFs or parse resident emails

- Predictive analytics: Using data trends to forecast outcomes like delinquency risk or occupancy shifts

How real estate AI is reshaping property operations

The first wave of AI in real estate focused on marketing and sales. Think listing descriptions, lead scoring, and chatbot routing. Useful, yes, but none of that addresses the operational drag that quietly erodes NOI: manual audits, inconsistent follow-up, fragmented data, and compliance gaps that surface too late.

The next wave looks different. Modern AI monitors data continuously, flags issues as they emerge, and executes multi-step workflows without waiting for a prompt. It’s less like a tool you use and more like a teammate that works while you’re focused elsewhere.

Predictive analytics and big data in real estate

Large portfolios generate enormous volumes of data: rent rolls, payment histories, lease terms, maintenance requests, resident communications. Predictive analytics turns that raw information into something actionable.

Machine learning models can identify residents at elevated risk of non-payment based on payment patterns and lease history. Asset managers can spot occupancy soft spots before they show up in monthly reports. The goal isn’t just reporting what happened. It’s forecasting what’s likely to happen next, so teams can act earlier.

Machine learning for lease and revenue analysis

Lease documents are dense, inconsistent, and often scattered across multiple systems. Machine learning can scan thousands of lease PDFs to detect discrepancies: a concession that wasn’t applied correctly, a pet fee missing from the ledger, a renewal term that conflicts with policy.

This kind of analysis used to require manual spreadsheet audits, typically done quarterly at best. Lease automation makes it continuous. Every new lease or amendment triggers a review, and exceptions surface immediately rather than at month-end close.

Generative AI for document processing and communication

Generative AI, the technology behind tools like ChatGPT, has obvious marketing applications: drafting listing descriptions, social posts, and email campaigns. In operations, though, its value lies in processing and generating documents at scale.

AI can draft delinquency notices, summarize lease terms for onsite teams, or generate exception reports for regional managers. The key distinction is that operational generative AI is trained on your data, your leases, your policies, your communication templates, not generic internet content.

Why AI Matters in the Real Estate Industry

Real estate is fundamentally a data-heavy industry. Every decision depends on:

-

Lease agreements

-

Financial assumptions

-

Operating expenses

-

Market conditions

-

Portfolio performance

As portfolios scale, traditional spreadsheet-based workflows struggle to keep pace. AI helps real estate teams:

-

Analyze more data with consistency

-

Reduce manual review effort

-

Surface risks earlier

-

Improve confidence in decision-making

This is why AI adoption is accelerating across the real estate industry.

Benefits of AI for real estate professionals

The benefits of AI in property operations are concrete and measurable. McKinsey has observed real estate companies gain over 10 percent in NOI through more efficient operating models. They cluster around a few core outcomes.

Automate manual tasks and reduce administrative burden

Onsite teams spend hours each week on data entry, document sorting, and status tracking. AI handles these tasks in the background, freeing staff to focus on resident relationships, leasing activity, and exception handling rather than administrative chores.

Protect revenue and minimize leakage

Missed charges, incorrect concessions, and billing errors add up quickly. A single missed pet fee across a 500-unit portfolio at $35 per month represents over $200,000 in annual revenue leakage. AI catches discrepancies before they compound into material losses.

Maintain compliance with continuous oversight

Compliance isn’t a one-time audit. It’s an ongoing requirement. AI monitors for unsigned documents, missing addenda, and out-of-policy terms in real time, reducing exposure to regulatory fines and legal disputes that can arise from documentation gaps.

Operate around the clock with AI agents

Unlike traditional software that responds when prompted, AI agents work continuously. They monitor lease changes overnight, flag delinquencies on weekends, and surface issues before the Monday morning standup. The work happens whether anyone is watching or not.

Accelerate transactions and shorten timelines

During acquisitions and transitions, AI compresses the time from LOI to insight. Instead of weeks of manual file review, AI extracts and analyzes resident data in hours, surfacing red flags before they become surprises at closing.

Core AI Use Cases in Real Estate

1. AI for Real Estate Investment Analysis

AI is increasingly used to support real estate investing by:

-

Analyzing lease and financial data at scale

-

Validating underwriting assumptions

-

Identifying outliers across portfolios

-

Supporting faster acquisition decisions

This is especially valuable during transactions where time constraints limit manual review.

Related reading:

AI Real Estate Deal Analyzer →

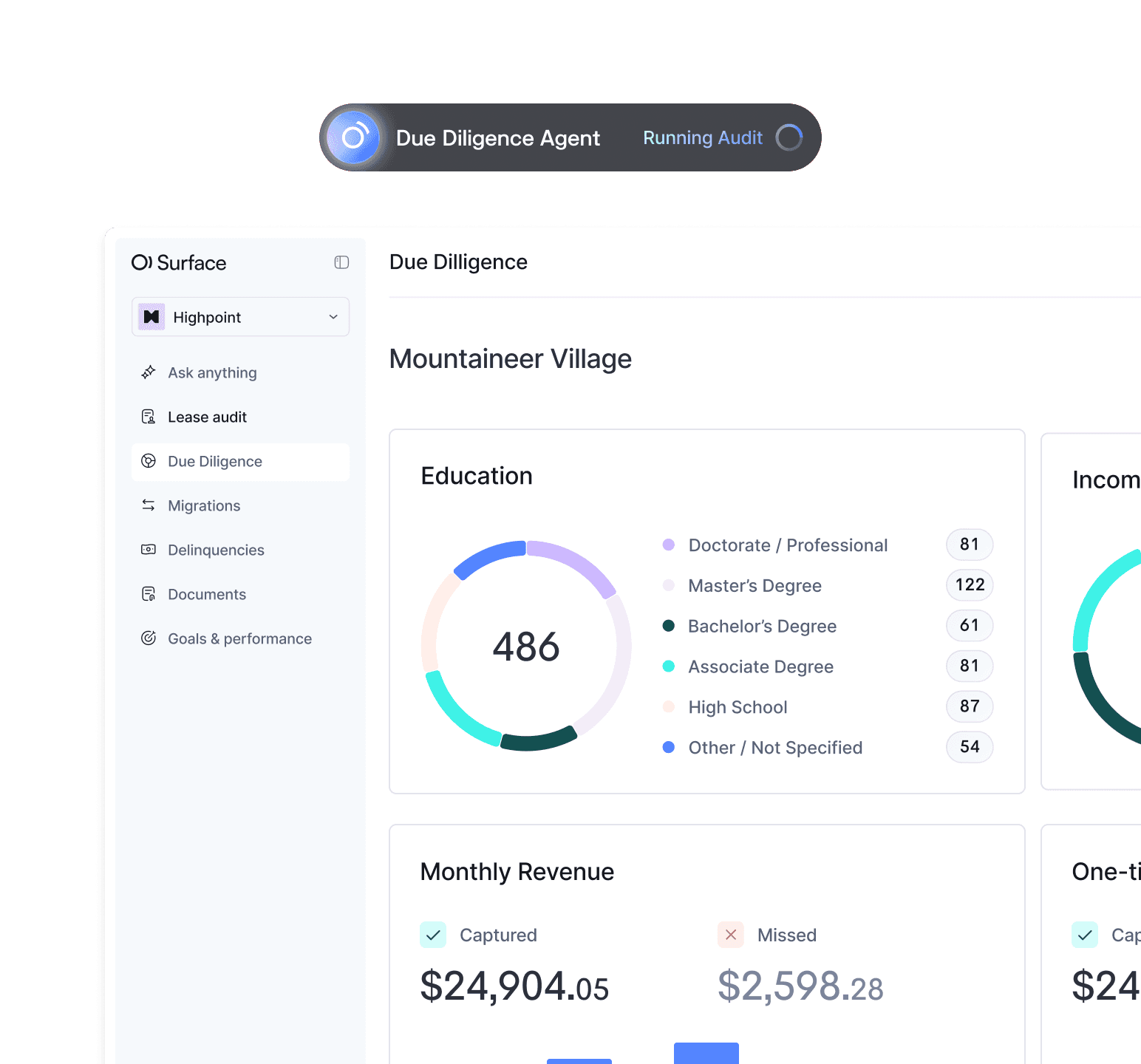

2. AI for Due Diligence

Due diligence is one of the most impactful applications of AI in real estate.

AI enables teams to:

-

Review all lease documents, not just samples

-

Identify inconsistencies or missing data

-

Reduce reliance on manual spreadsheets

-

Improve post-close confidence

SurfaceAI’s Due Diligence Agent and Lease Audit Agent are purpose-built for this phase.

3. AI in Leasing Operations

AI supports leasing teams in two distinct ways:

-

Front-end communication (assistants, chat interfaces)

-

Back-end analysis (lease validation, compliance)

While conversational AI improves responsiveness, analytical AI improves accuracy.

Related reading:

AI Leasing Agents & Multifamily Chatbots →

4. AI in Property and Asset Management

AI helps operators manage assets more effectively by:

-

Monitoring lease compliance

-

Detecting revenue leakage

-

Organizing documents across systems

-

Providing portfolio-level visibility

These capabilities connect daily operations to long-term investment performance.

Related reading:

AI Use Cases in Asset Management →

Real Estate Asset & Investment Management Software →

5. AI in Real Estate Development

In development workflows, AI supports:

-

Feasibility analysis

-

Cost modeling

-

Scenario planning

-

Risk identification

While development-focused AI differs from operational AI, both rely on accurate data and structured analysis.

AI applications in property management and operations

The most impactful AI applications in multifamily aren’t flashy. They address the workflows that break at scale.

Lease auditing and revenue recovery

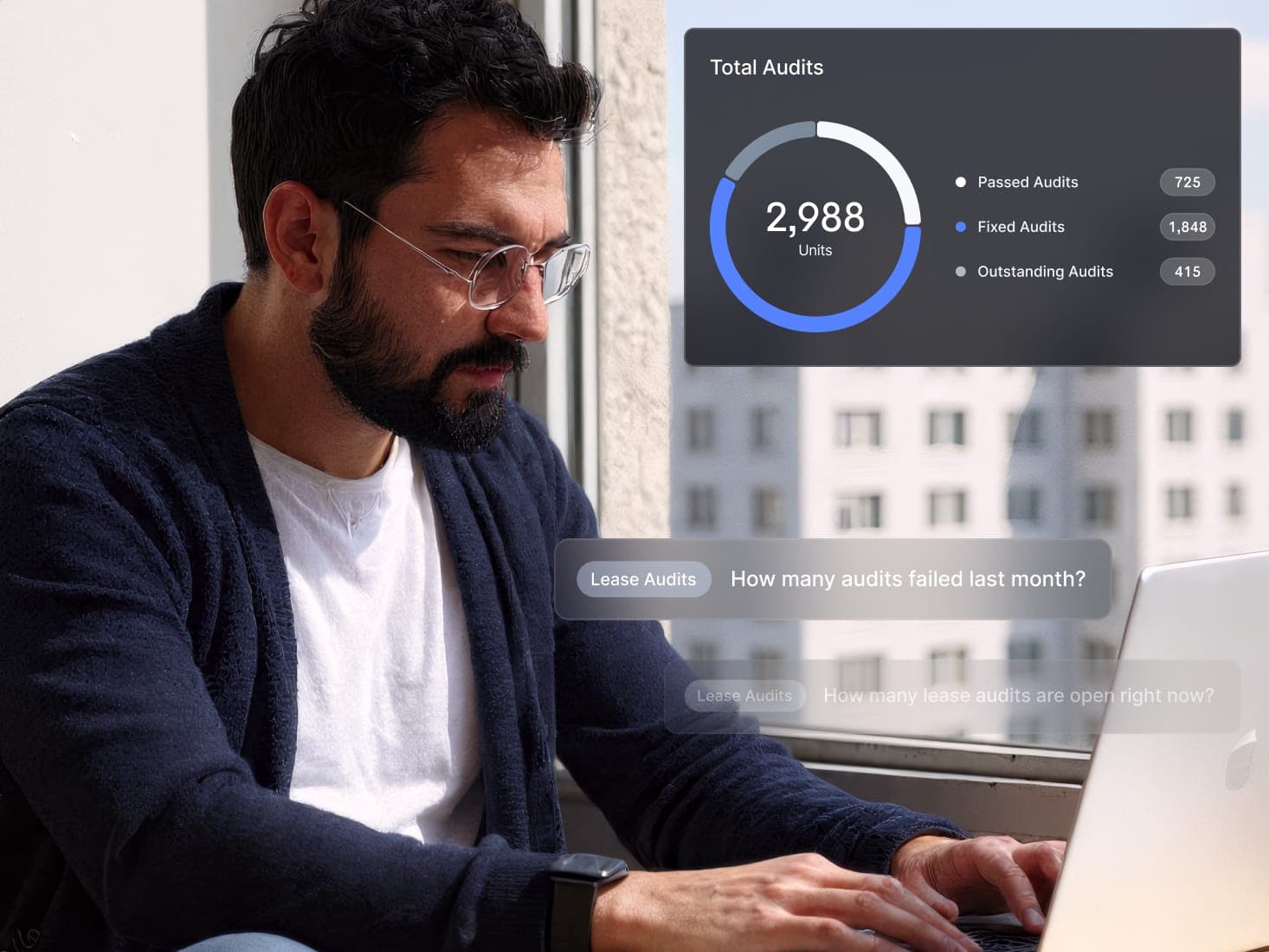

Continuous lease auditing is one of the highest-ROI applications of AI in property management. Rather than quarterly spot checks, AI monitors every lease change in real time: new leases, renewals, amendments, move-outs.

When an issue surfaces, whether a missing charge, an unsigned document, or a concession outside policy, the system flags it and assigns a task to the appropriate staff member. Platforms like SurfaceAI offer always-on audit agents designed specifically for this workflow, catching errors before they hit month-end close.

Delinquency management and rent collection

Manual delinquency workflows are inconsistent and labor-intensive. AI automates the entire lifecycle: first notice, reminder, escalation, and follow-up. Every communication is timestamped and logged, creating a defensible audit trail.

The result is faster resolution, more consistent resident experience, and reduced legal exposure. Instead of relying on individual site staff to remember follow-ups, the process runs automatically according to predefined rules.

Document classification and PMS migration

Property transitions generate mountains of paperwork: lease files, addenda, notices, and supporting documents. Automated document management ingests these files, classifies them by type, matches them to the correct resident, and uploads them into the property management system.

What used to take weeks of manual review now happens in days, with fewer errors and cleaner resident files from day one. Onsite teams can focus on operations rather than document cleanup.

Portfolio monitoring and operational visibility

Real-time financial monitoring gives operators a single view across properties. AI agents surface what’s urgent, what’s been handled, and what needs attention. Asset managers can track NOI drivers, compliance status, and resident risk without digging through spreadsheets or waiting for site-level reports.

AI for real estate due diligence and acquisitions

Transaction teams face a familiar challenge: too many documents, too little time, and too much at stake. AI changes the math.

Automated lease and resident data analysis

AI due diligence extracts key data points from rent rolls and lease PDFs automatically: resident names, lease terms, rent amounts, concessions, and payment history. No more manual abstraction or side-by-side comparison across hundreds of files.

Red flag detection for investment decisions

Beyond extraction, AI flags anomalies that signal risk: mismatched names or terms, unsigned documents, residents with prior evictions or bankruptcies, occupancy patterns that don’t match the rent roll. Red flags surface before closing, not after.

Compressing time from LOI to insight

Speed matters in competitive markets, with JLL research showing 23% faster transaction times for companies leveraging AI in decision-making. AI replaces file-by-file review with automated analysis, enabling acquisition teams to move faster and bid with more confidence. The goal is full visibility into risk and revenue impact before the deal closes.

How AI agents differ from chatbots and basic automation

Not all AI is created equal. The distinction between chatbots, automation, and AI agents matters for operators evaluating technology.

| Capability | Basic Automation | Chatbots | AI Agents |

|---|---|---|---|

| Trigger | Manual or scheduled | User prompt | Continuous monitoring |

| Scope | Single task | Q&A and routing | End-to-end workflows |

| Output | Pre-defined action | Text response | Tasks, flags, and actions |

| Oversight | None | Limited | Human-in-the-loop |

Chatbots answer questions. Automation executes pre-defined rules. AI agents monitor data continuously, make decisions within defined parameters, and execute multi-step workflows with human oversight at key checkpoints. The difference is between a tool that waits and a teammate that works.

AI real estate companies and tools for multifamily operators

The landscape of AI tools for real estate is broad and growing. For multifamily operators, the options fall into a few categories:

- PMS-integrated AI: Features embedded within property management systems like MRI, AppFolio, or Buildium, convenient but often limited in scope

- Point solutions: Standalone tools for specific tasks like virtual staging, lead scoring, or chatbot communication

- AI agent platforms: Systems that deploy multiple specialized agents across workflows, including lease audits, due diligence, and delinquency, from a single hub

The best fit depends on portfolio size, operational complexity, and the specific workflows that need improvement.

For operators managing thousands of units across multiple properties, platforms that unify data and coordinate agents across workflows tend to deliver the most value. SurfaceAI is one example of an AI agent platform built specifically for multifamily operations.

Risks and limitations of AI in real estate

AI is powerful, but it’s not magic. A few limitations are worth understanding before deployment.

Data quality and integration challenges

AI is only as good as the data it ingests. Fragmented systems, inconsistent rent rolls, and poor document hygiene limit effectiveness. Before deploying AI, operators often need to clean up their data infrastructure and ensure systems can communicate.

Over-reliance on automation without human oversight

AI augments teams. It doesn’t replace judgment. The risk of “set and forget” is real. Effective implementations maintain human oversight at key decision points, especially for compliance-sensitive workflows where errors carry legal consequences.

Privacy and security considerations

AI platforms handle sensitive resident and financial data. Permission-aware access, secure integrations, and clear data handling policies are non-negotiable. Operators evaluating vendors benefit from assessing security posture alongside feature sets.

How SurfaceAI Fits Into the AI Real Estate Landscape

SurfaceAI is not a general-purpose AI tool and not a property management system.

SurfaceAI applies AI through specialized agents designed for real estate diligence and operations, including:

-

Lease Audit Agent

-

Due Diligence Agent

-

Document Management Agent

These agents analyze real lease documents and operational data, surfacing issues that impact revenue, compliance, and confidence.

SurfaceAI integrates with existing systems rather than replacing them.

“I’ve been thoroughly impressed with the Surface AI lease audit product. It’s exceptionally user-friendly, and the audit results are clear, concise, and easy to interpret. The impact on our student teams has been tremendous—what once took several days can now be completed in just a few hours. The tool also makes it simple to identify and address issues efficiently. I can’t speak highly enough about the value this product brings.”

Gary Robbins, Transitions Manager

Building an AI strategy for property operations

For operators evaluating AI, a few principles help guide the decision:

- Start with high-impact workflows: Lease audits, delinquency, and document management offer measurable ROI and clear before-and-after metrics

- Prioritize integration: AI that doesn’t connect to your PMS and storage tools creates more silos, not fewer

- Choose agents over chatbots: Look for AI that acts on workflows continuously, not just responds when prompted

- Maintain human oversight: Ensure teams can monitor, review, and override AI outputs, especially for compliance-sensitive tasks

For multifamily operators ready to deploy AI agents across lease audits, due diligence, and delinquency workflows, book a demo with SurfaceAI.

Frequently asked questions about AI for real estate