USA Multifamily Investment Trends and Insights

The U.S. multifamily sector represents one of the largest and most actively traded real estate asset classes in the country, with trailing twelve-month sales of $157.7 billion, yet operational complexity at scale remains the primary barrier between strong fundamentals and actual returns. Investment performance ultimately depends on execution, how well operators capture revenue, maintain compliance, and manage data across growing portfolios.

This article covers what multifamily real estate is, how the U.S. market is performing, which metrics matter for investment decisions, and where operational challenges create both risk and opportunity for owners and operators.

What is multifamily real estate

Multifamily real estate refers to residential properties with multiple separate housing units under single ownership. The Office of Multifamily Housing Programs under HUD administers federal programs supporting this sector, which serves millions of American renters across conventional, affordable, and workforce housing segments. Think apartment buildings, not single-family homes.

The category includes several distinct property types:

- Duplex/Triplex: Two or three units in a single building, often owner-occupied with rental income from the other units

- Garden-style apartments: Low-rise buildings spread across landscaped grounds, typically two to three stories, common in suburban markets

- Mid-rise and high-rise: Larger buildings with elevators, usually found in urban cores where land costs justify building up rather than out

Here’s where things get interesting. As unit counts grow, operational complexity grows with them. A 200-unit property generates thousands of lease documents, payment records, and maintenance requests every year. Managing all of that manually, through spreadsheets and spot checks creates real challenges around data accuracy, compliance tracking, and revenue capture.

USA multifamily market size and performance

National market growth

The U.S. multifamily sector has expanded significantly over the past decade. Urbanization continues to concentrate population in metropolitan areas, while household formation patterns increasingly favor renting over homeownership. Younger adults facing affordability constraints drive much of this shift, with average mortgage payments 35% above rents keeping many households in rental housing, though the trend extends across age groups.

Renter preferences have also evolved. Many households now choose to rent for flexibility, amenities, or lifestyle reasons – not purely economic necessity. This shift has expanded demand across income levels and property classes, supporting both luxury and workforce housing segments.

Regional differences in rent and occupancy

Market performance varies substantially by geography. Sun Belt states like Texas, Florida, and Arizona have attracted significant migration from higher-cost coastal metros, driving strong demand but also triggering substantial new construction.

| Region | Demand Trend | Supply Trend |

|---|---|---|

| Sun Belt | Strong in-migration, job growth | Heavy construction pipeline |

| Coastal | Stable but constrained by affordability | Limited new supply due to regulations |

| Midwest | Moderate growth, workforce-driven | Selective development |

Regional dynamics directly affect investment strategy. Markets with strong demand but heavy supply may see rent compression during lease-up periods, with Sun Belt rent gains as low as 0.1% amid elevated deliveries. Meanwhile, supply-constrained markets often maintain pricing power but offer fewer acquisition opportunities.

Institutional and private ownership trends

Ownership of U.S. multifamily assets has shifted meaningfully toward institutional capital. Real estate investment trusts (REITs), private equity funds, and large syndications now control substantial portions of the rental housing stock, particularly in major metros.

This institutional presence has raised operational standards across the industry. Larger owners typically deploy sophisticated property management systems, standardized reporting, and technology platforms. The gap between institutional-grade operations and legacy manual processes continues to widen – and that gap often shows up in NOI performance.

USA multifamily investment trends

Rent growth and occupancy shifts

Rent growth has moderated from the exceptional pace seen in 2021 and 2022, though it remains positive in most markets. Occupancy rates have stabilized in the mid-90 percent range nationally, with variation by submarket and property class.

Concession activity has increased in markets with heavy new supply, particularly for Class A properties competing for the same renter pool. Operators in high-supply markets face pressure to balance occupancy targets against effective rent erosion, a tradeoff that directly affects net operating income.

New construction and supply dynamics

The construction pipeline remains elevated, with deliveries concentrated in Sun Belt metros and select urban cores. Multifamily completions have reached their highest levels in nearly four decades, creating absorption challenges in certain submarkets.

Lease-up risk has become a meaningful consideration for investors. Properties entering a market with significant competing supply may take longer to stabilize, affecting projected returns and debt service coverage during the initial operating period. Underwriting assumptions that worked two years ago may not hold today.

Affordable and workforce housing demand

Workforce housing, typically serving households earning 60 to 120 percent of area median income, has attracted growing investor interest. Properties in this segment often benefit from more stable occupancy and lower turnover than luxury assets, though they may face rent growth constraints.

Regulatory incentives including Low-Income Housing Tax Credits (LIHTC) and local inclusionary zoning requirements have expanded the affordable housing investment landscape. Operators in this segment navigate additional compliance requirements but often access favorable financing terms in return.

Technology adoption across portfolios

Property technology adoption has accelerated across the multifamily sector. Operators increasingly deploy workflow automation for leasing, maintenance coordination, resident communication, and financial reporting.

Yet technology adoption remains uneven. Many portfolios still rely on disconnected systems, manual data entry, and spreadsheet-based tracking for critical functions like lease audits and delinquency management. This fragmentation creates operational blind spots that affect both revenue capture and compliance posture, problems that compound as portfolios scale.

Largest multifamily REITs and operators in the United States

A REIT, or real estate investment trust, is a company that owns, operates, or finances income-producing real estate and trades on public exchanges like stocks. REITs offer investors exposure to real estate returns without direct property ownership, and they’re required to distribute at least 90 percent of taxable income to shareholders.

The largest publicly traded multifamily REITs by portfolio size include:

- Equity Residential: Focused on high-density urban markets including Boston, New York, San Francisco, and Seattle

- AvalonBay Communities: Diversified across coastal and select expansion markets with both urban and suburban assets

- Mid-America Apartment Communities (MAA): Concentrated in Sun Belt markets with a suburban garden-style focus

- UDR, Inc.: Balanced portfolio across coastal and Sun Belt metros

- Camden Property Trust: Strong presence in Texas, Florida, and other growth markets

Large private operators and third-party management companies also control substantial portfolios, often managing assets on behalf of institutional investors. The operational practices of major players set benchmarks that influence industry-wide standards.

Essential multifamily investment metrics

The 1% rule

The 1% rule is a quick screening tool suggesting that monthly rent equals at least 1% of a property’s purchase price. For example, a property purchased for $500,000 would generate $5,000 in monthly rent to meet this threshold.

This rule provides a rapid initial filter but has significant limitations. In high-cost coastal markets, few properties meet the 1% threshold, yet many still generate attractive risk-adjusted returns. The rule works better as a starting point than a definitive investment criterion, useful for quickly eliminating deals that don’t pencil, less useful for comparing opportunities in different markets.

Cap rate and net operating income

Net operating income (NOI) represents a property’s revenue minus operating expenses, excluding debt service and capital expenditures. Cap rate, or capitalization rate, equals NOI divided by property value, expressed as a percentage.

Investors use cap rates to compare properties and assess relative value. A property generating $100,000 in NOI valued at $2 million has a 5% cap rate. Lower cap rates typically indicate lower perceived risk or stronger growth expectations, while higher cap rates may signal either opportunity or elevated risk. Context matters, a 6% cap rate means something different in Manhattan than in Memphis.

Debt service coverage ratio

Debt service coverage ratio (DSCR) measures a property’s ability to cover its debt payments from operating income. Lenders typically require DSCR of 1.20x to 1.25x or higher, meaning NOI exceeds annual debt service by 20 to 25 percent.

DSCR constraints directly affect acquisition financing and refinancing. Properties with thin coverage ratios may require additional equity, higher interest rates, or operational improvements to secure favorable loan terms. In a higher interest rate environment, DSCR becomes an even more critical constraint on deal viability.

Operational challenges in USA multifamily portfolios

Investment returns ultimately depend on operational execution. Even well-located assets with strong fundamentals can underperform when lease errors erode revenue, compliance gaps create legal exposure, or transition delays prevent teams from managing properties effectively. The operational failures often go undetected until they materially affect NOI, by which point the damage is already done.

Revenue leakage from lease errors

Missed charges, incorrect rent amounts, and unapplied fees create direct revenue loss that compounds over time. A single $50 monthly error across 100 units equals $60,000 in annual leakage, often invisible until a detailed audit surfaces the discrepancy.

Manual lease audits typically occur quarterly or during transitions, leaving months of potential errors undetected. The gap between when errors occur and when they’re caught represents real money left on the table. And in a business where margins matter, that leakage adds up fast.

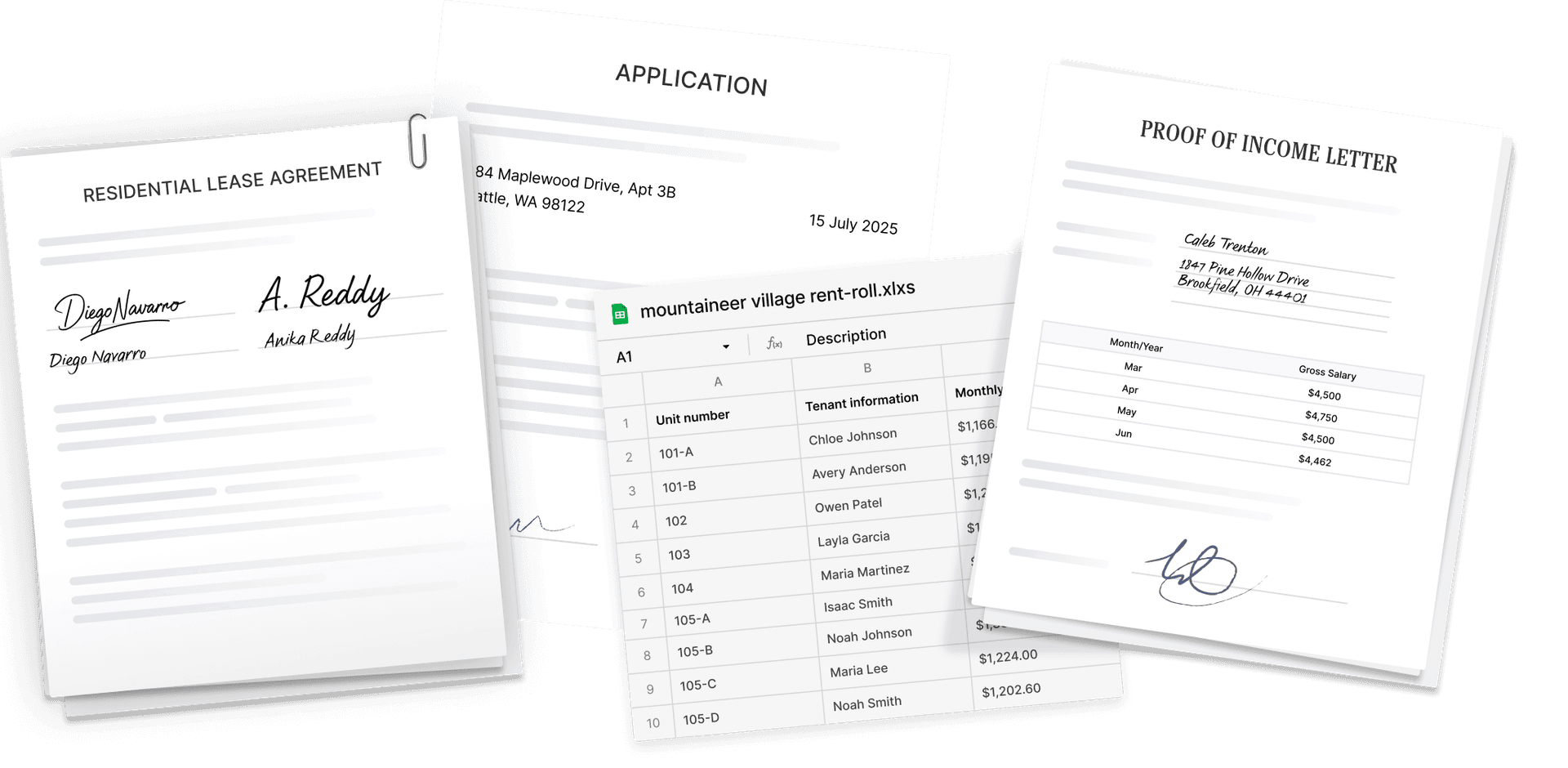

Due diligence bottlenecks during acquisitions

Acquisition due diligence requires reviewing individual lease files, verifying rent roll accuracy, and assessing resident payment history. For a 300-unit property, this means examining hundreds of documents under tight transaction timelines.

Manual review processes create bottlenecks that either delay closings or force teams to accept incomplete information. Errors discovered post-acquisition become the buyer’s problem, affecting projected returns and creating unexpected operational burdens. The pressure to close quickly often conflicts with the need to understand what you’re actually buying.

Document management gaps in property transitions

Property takeovers require migrating resident files, lease documents, and operational records into new management systems. This process often takes weeks of manual classification, matching, and upload work.

Document backlogs delay operational readiness and create blind spots for onsite teams. Staff may lack access to complete resident files, leading to communication errors, missed renewal opportunities, and compliance gaps. A property isn’t truly “taken over” until the data is clean and accessible.

Fragmented data across properties and systems

Portfolio data typically lives across multiple property management systems, cloud storage platforms, spreadsheets, and email threads. This fragmentation prevents operators from achieving true portfolio-wide visibility.

Without unified data, identifying patterns, whether positive trends to replicate or problems to address, requires manual aggregation that rarely happens consistently. Operators make decisions based on incomplete information, often discovering issues only after they’ve affected financial performance.

How AI is transforming USA multifamily operations

AI agents represent a distinct category from chatbots or simple automation tools. Rather than responding to queries, AI agents act continuously in the background, monitoring data, flagging issues, and executing workflows without requiring constant human direction. They function as operational teammates rather than passive software.

Continuous lease audits with AI agents

Traditional lease audits happen periodically, quarterly reviews or transition-triggered checks that leave gaps between examinations. AI-powered continuous auditing monitors every lease change as it occurs, flagging discrepancies immediately rather than months later.

SurfaceAI’s Lease Audit Agent exemplifies this approach, running around the clock to catch missing charges, unsigned documents, and out-of-policy terms the moment they appear. This shifts lease auditing from a reactive cleanup exercise to a proactive control function that protects revenue in real time.

Automated due diligence for faster acquisitions

AI can extract and analyze resident data from rent rolls and lease PDFs at speeds impossible for manual review. AI due diligence surfaces red flags, mismatched names, payment history concerns, occupancy anomalies, before they become post-acquisition surprises.

SurfaceAI’s Due Diligence Agent compresses the time from LOI to insight, enabling acquisition teams to make informed decisions without sacrificing thoroughness for speed. The goal isn’t to replace human judgment but to ensure that judgment is based on complete information.

Unified workspace for portfolio visibility

An operational command center brings together data from disparate systems into a single view, enabling teams to see what’s happening, what’s urgent, and what’s already been handled across an entire portfolio.

SurfaceAI’s Intelligent Workspace serves as this hub, where AI agents operate and teams monitor operations. The built-in Ask Anything feature delivers contextual answers grounded in a company’s own policies and documents, eliminating the need to search across multiple systems for basic information.

Building a smarter multifamily website and operations hub

A modern multifamily operations platform extends beyond marketing websites and basic property management software. It serves as the central intelligence layer where AI agents live, operational data converges, and teams take action based on real-time portfolio visibility.

This hub approach transforms how operators manage at scale. Instead of logging into multiple systems, reconciling spreadsheets, and chasing down information, teams access a unified view that surfaces what matters and automates what doesn’t require human judgment.

The operators who thrive in the next decade will be those who treat operational technology not as a cost center but as infrastructure, one that protects NOI, ensures compliance, and frees teams to focus on the work that actually moves performance.

Frequently asked questions about USA multifamily investing

Related content