The Hidden Cost of Lease Audit Backlogs in Multifamily Operations

The lease audit function in multifamily operations is under intense strain. With property portfolios expanding and compliance demands increasing, manual lease audits now result in significant delays, often requiring months to complete and multiple full-time staff. These backlogs introduce financial risk, operational inefficiency, and compliance exposure. Operators are rethinking the audit function as a strategic capability, leading many to invest in automation and real-time auditing platforms that transform how lease terms are verified and discrepancies are resolved. For multifamily operators, the choice is no longer whether to modernize lease audits, but how fast.

The Strategic Importance of Lease Audits in Multifamily

In an era of institutional capital and data-rich property management, multifamily operations have never been more complex. Yet, one area remains stubbornly analog and prone to operational breakdown: lease audits. Once viewed as a necessary but routine administrative process, lease audits have become a strategic fault line where operational scale meets systemic inefficiency.

Backlogs Reflect a Systemic Mismatch Between Scale and Process

Across the industry, the average operator is struggling with lease audit backlogs that stretch as long as eight months. Completing these audits often requires the full-time labor of at least two dedicated staff members. The sheer volume of files, variance in property management systems (PMS), and increasing regulatory scrutiny around fee transparency are pushing traditional manual processes to the brink.

At the root of this backlog is a structural mismatch: the expectations of modern portfolio management, efficiency, accuracy, compliance, collide with outdated methods that rely heavily on human labor and file-by-file review. This is particularly problematic for operators managing dozens or even hundreds of properties, where minor inefficiencies can scale into major financial and legal liabilities.

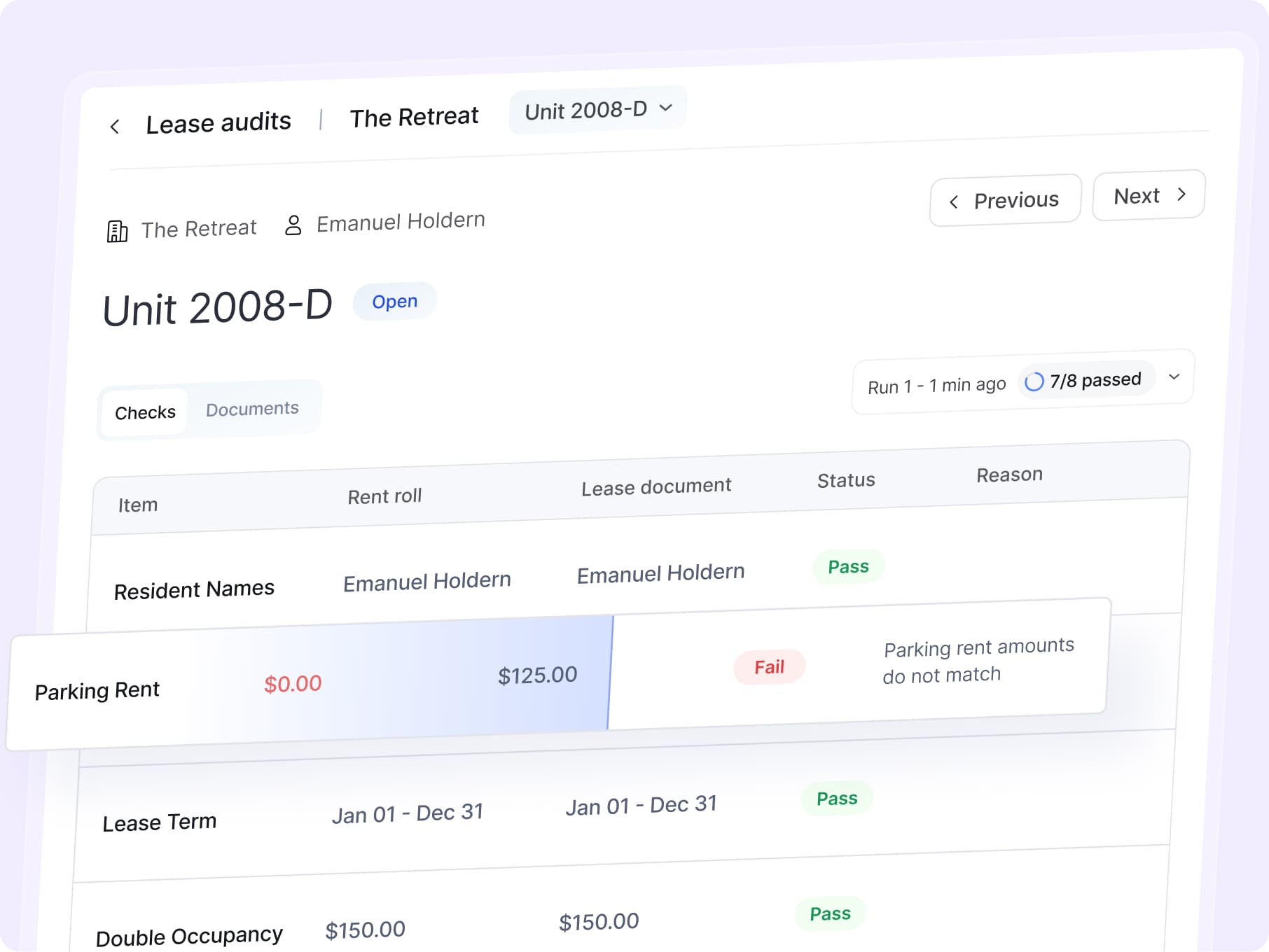

The Pain Points Behind Every Audit

A deeper look into the lease audit process reveals several pain points. First, there is the challenge of verifying that an executed lease exists for every resident on the rent roll. Second, those lease terms must match exactly what is reflected in the PMS, errors in rent amounts, lease durations, or concession terms can lead to revenue leakage or compliance risk. Third, operators must ensure that all required documents, including addenda and fee schedules, are present and properly categorized. Missed documents often only come to light during litigation, audits, or tenant disputes.

Inconsistency Is the Hidden Culprit

One under-appreciated challenge is the inconsistency in how documents are stored and named across portfolios. Each property takeover introduces new digital (or sometimes physical) filing structures, varied naming conventions, and a mix of document types. This fragmentation becomes a bottleneck when trying to implement uniform audit procedures at scale. As a result, even seasoned property managers find themselves mired in administrative tasks, pulling time away from higher-value activities such as resident engagement, maintenance oversight, or leasing.

Financial and Compliance Risk Amplified by Delays

These operational challenges have direct implications for financial performance. When audit backlogs persist, errors remain undetected. Improperly applied fees or unrecognized concessions can misrepresent net operating income (NOI), leading to flawed budgeting, missed financial targets, or investor dissatisfaction. Moreover, audits are increasingly tied to compliance. Municipalities and state agencies are tightening regulations around how fees are disclosed and charged. A mislabeled utility charge or improperly documented violation notice can trigger costly disputes or penalties.

Erosion of Trust, The Most Critical Risk

The most concerning consequence, however, may be the erosion of trust, both internal and external. Owners question the accuracy of their financial reporting. Asset managers struggle to compare performance across properties. And investors, increasingly familiar with institutional-grade reporting from other asset classes, begin to question whether the multifamily industry is keeping pace.

How AI Agents Are Rewriting the Lease Audit Playbook

It doesn’t have to be this way. Leading operators are beginning to rethink the lease audit process as a strategic capability rather than a compliance afterthought. Automation technologies, particularly those leveraging AI Agents and machine learning, are offering a compelling alternative to the manual grind.

By connecting directly with the PMS, these systems can run audits continuously, flagging discrepancies in near real-time. AI tools can extract data from lease documents regardless of formatting, compare it to PMS entries, and trigger automated workflows to alert property managers only when human judgment is required. This reduces the time spent on routine reviews while increasing audit coverage.

The Case for a Centralized Audit Dashboard

Moreover, these tools create a central audit dashboard, one that offers visibility across the portfolio, enabling asset managers and compliance teams to monitor issues, track resolution timelines, and identify systemic gaps. Such platforms also support override and permission structures, ensuring that operational control is maintained even as automation scales.

A Broader Trend: Continuous Auditing in Other Industries

This transition, from manual backlog to real-time monitoring, mirrors trends seen in other sectors. In finance, continuous auditing replaced quarterly spot checks. In logistics, real-time shipment tracking rendered inventory delays unacceptable. Multifamily is on the cusp of a similar transformation.

The Risk of Inaction in a Scaling Industry

Yet, adoption remains limited. Concerns about implementation burden, upfront cost, and change management are common. But these challenges are increasingly outweighed by the risk of inaction. As portfolios scale and investor expectations rise, lease audit resilience will become a defining trait of high-performing operators.

Important Takeaways for Operators

The solution is not to throw more people at the problem. It is to rethink the problem itself. Lease audits are not merely back-office tasks. They are levers of financial control, regulatory compliance, and organizational trust. In that light, failing to modernize is not just inefficient, it’s strategically unsound.