Rethinking Due Diligence: Why Multifamily Acquisitions Need Automated Intelligence

In multifamily acquisitions, traditional due diligence processes are no longer sufficient to keep pace with transaction complexity, investor expectations, and financial risk. Manual reviews of leases, resident ledgers, and rent rolls are labor-intensive, error-prone, and inherently backward-looking. As portfolios scale and deal velocity increases, automation has emerged as a necessary tool to surface hidden risks and improve the quality of underwriting. This article explores how automated due diligence is reshaping the acquisition process, improving risk visibility, and enhancing long-term investment outcomes.

The Due Diligence Gap in Multifamily Transactions

Due diligence is the backbone of real estate acquisition, yet in many multifamily deals, the process remains heavily reliant on manual document review and spreadsheet analysis. Acquisitions often hinge on interpreting hundreds or thousands of leases, reconciling them against rent rolls, and identifying inconsistencies in charges, concessions, or legal terms. This is typically performed under time pressure, with lean teams and limited access to structured data.

The limitations are well-documented. A 2023 Real Capital Analytics report found that nearly 40 percent of multifamily acquisitions experienced negative cash flow variance post-close due to operational risks or resident liabilities that were not identified during diligence. These include issues such as overstated occupancy, misapplied concessions, incorrect deposit balances, or legal noncompliance in lease language. Even in well-run transactions, due diligence is rarely exhaustive.

Why Manual Review Falls Short

There are three structural weaknesses in the traditional diligence process:

- Volume vs. Velocity: Most acquisition teams are reviewing lease files while under exclusivity, often with less than 30 days to complete the entire diligence process. Reviewing hundreds of documents manually leaves little time to identify outliers or verify accuracy.

- Static Snapshots: Diligence typically captures a point-in-time view of the asset, based on rent rolls and financials provided by the seller. Yet these documents may not reflect pending renewals, active resident disputes, or shifting delinquency patterns.

- Inconsistent Standards: Human-led review processes vary from deal to deal, depending on who is conducting them. This variability introduces blind spots and exposes investors to risk that is neither quantified nor priced.

These gaps not only threaten deal performance but also erode investor confidence in the operator’s ability to manage risk during the most critical phase of the investment cycle.

The Role of Automation in Due Diligence

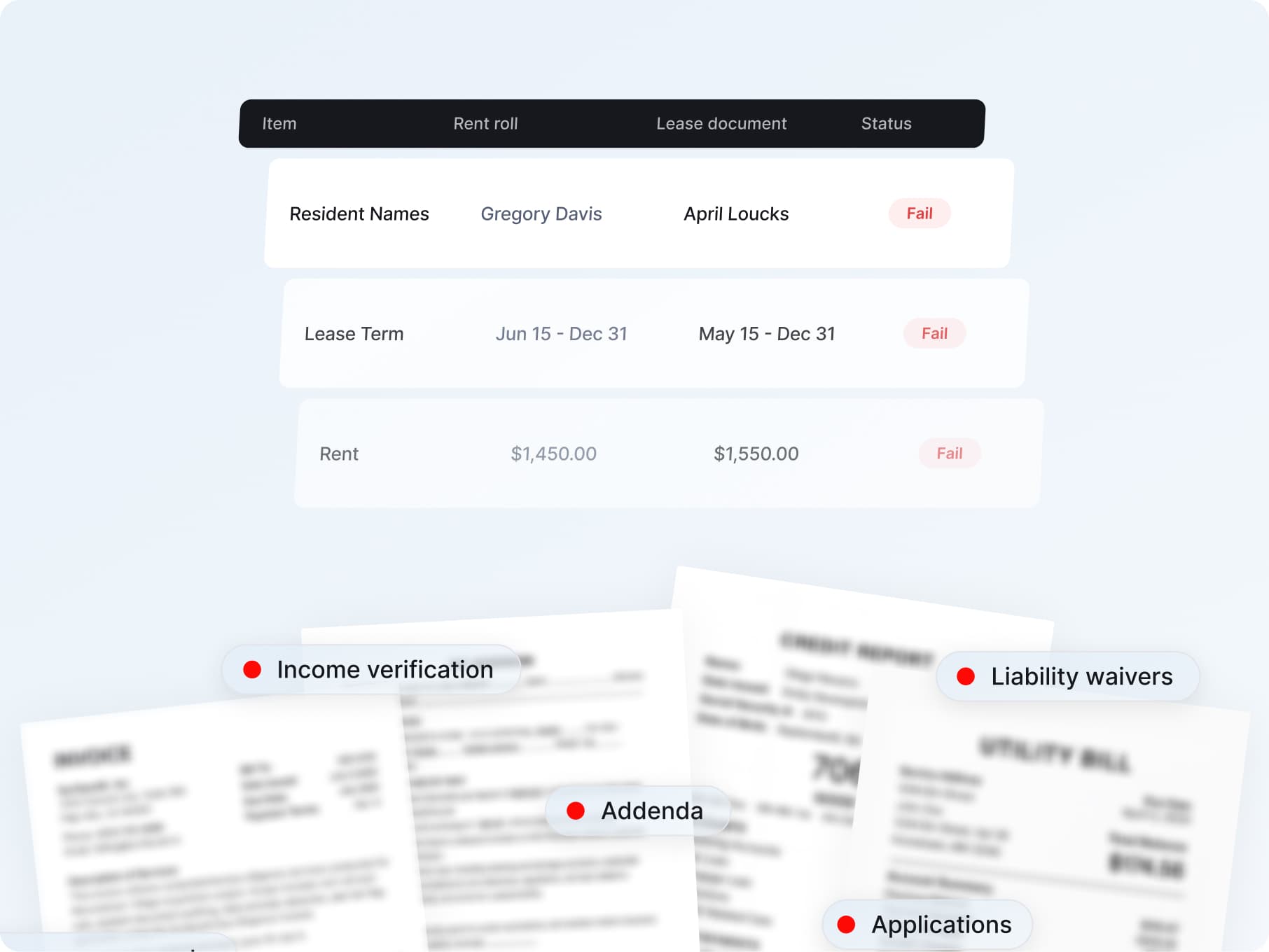

Automated due diligence introduces a new layer of intelligence into the acquisition process. By ingesting lease documents, resident ledgers, and financial records in bulk, automation tools can flag inconsistencies, detect red flags, and benchmark operational inputs in a fraction of the time manual processes require.

For example, automation can identify if a unit has multiple occupants listed in the ledger but only one on the lease, or if pet rent is being charged inconsistently across similarly configured units. It can verify that concessions have expiration dates, and that those dates align with the billing history. It can also surface anomalies in security deposit balances, outstanding fees, or mismatches between signed lease terms and system records.

This level of detail is rarely available in traditional processes, yet it is critical to understanding the true operating profile of an asset. In several recent institutional transactions, automated diligence tools uncovered rent mischarges that altered the asset’s net effective rent by over 3 percent, enough to materially affect valuation.

Shifting from Compliance to Competitive Edge

Automated diligence is not just about finding errors. It represents a broader shift toward treating diligence as a strategic function rather than a compliance checklist. When executed well, it produces three key benefits:

- Speed and Scale: Automation allows investors to complete deeper reviews in less time. This reduces reliance on seller-provided summaries and enables teams to focus on analysis rather than extraction.

- Risk Quantification: Rather than offering vague concerns about “lease file quality,” automation allows operators to assign dollar values to identified risks. This supports renegotiation, repricing, or post-close adjustments with clear documentation.

- Institutional Credibility: Sellers and investors increasingly expect a disciplined approach to diligence. Operators who can demonstrate automated, repeatable processes signal professionalism and risk maturity.

Implications for Operators and Capital Partners

As multifamily acquisitions continue to grow in complexity, the cost of missed diligence increases. Whether it is acquiring value-add portfolios with variable resident histories or managing regulatory exposure in rent-controlled markets, buyers need deeper insight and faster analysis.

Private equity firms are also beginning to require more structured diligence reporting from their operating partners. The expectation is shifting from “show us the leases” to “show us how the leases were verified.” Operators who rely solely on manual processes will find themselves at a disadvantage in increasingly competitive bidding environments.

Looking Ahead: Due Diligence as a Strategic Discipline

Multifamily executives must move beyond the traditional view of diligence as a deal gate. It is, in fact, the foundation of operational forecasting and investment strategy. When done with precision, diligence uncovers where an asset’s cash flow may be weaker, or stronger, than it appears. It surfaces liabilities that will require post-close remediation and identifies areas where operational upgrades can yield immediate value.

In this context, automation is not a threat to underwriting, it is its natural evolution. Operators who embrace automated diligence workflows will not only reduce risk but also build a repeatable edge in deal execution, underwriting accuracy, and investor trust.