Multifamily Property Management: Technology, Software, and Modern Operations

Multifamily property management is the oversight of residential buildings with multiple rental units, from duplexes to large apartment complexes, under single ownership. The work spans tenant relations, rent collection, maintenance, lease administration, and financial reporting, all with one objective: keep units occupied and protect net operating income.

As portfolios grow, the operational complexity compounds. Manual workflows that function at 200 units break at 2,000, and the resulting inefficiencies, missed charges, documentation gaps, inconsistent collections, erode NOI in ways that often go unnoticed until they show up in year-end financials. This guide covers core responsibilities, common challenges, and the automation tools that help modern operators scale without proportional headcount increases.

What is multifamily property management

Multifamily property management is the oversight of residential buildings with multiple rental units under single ownership. The work spans tenant relations, rent collection, maintenance coordination, lease administration, and financial reporting. Whether an owner handles operations in-house or hires a third-party multifamily property management company, the objective stays the same: keep units occupied, protect revenue, and maintain the physical asset.

Property type determines operational complexity. A duplex or small multifamily property with two to four units can often be owner-managed with minimal systems. Apartment complexes and large multifamily housing, five or more units, typically require dedicated staff, formal processes, and property management software to track leases, work orders, and financials across the portfolio.

Mixed-use properties and condominiums add coordination with homeowner associations, shared common areas, and sometimes commercial tenants alongside residential units.

How Multifamily Property Management Has Changed

Historically, multifamily operations relied on manual processes:

-

Paper leases and physical files

-

Spreadsheets for rent tracking

-

Phone-based leasing and service coordination

-

Reactive maintenance workflows

Today’s multifamily environment demands more. Operators face:

-

Higher resident expectations

-

Increased regulatory complexity

-

Pressure to improve efficiency and NOI

-

Greater scrutiny from investors and lenders

As a result, multifamily property management has become deeply technology-driven.

Key Operational Areas in Multifamily Property Management

Leasing and Resident Lifecycle

From lead inquiry to renewal, leasing workflows require coordination across marketing, tours, applications, and documentation. Technology plays a central role in reducing response times and improving conversion rates.

To see how automation supports leasing workflows, explore AI leasing agents for multifamily →

Maintenance and Operations

Property management teams must manage ongoing maintenance while minimizing disruption to residents. Technology helps prioritize requests, schedule work, and track completion efficiently.

Financial Oversight

Accurate rent tracking, billing, and reporting are critical for performance and compliance. Property management systems feed this data into reporting and accounting tools.

For how reporting fits into operations, see real estate reporting software →

Compliance and Documentation

Lease agreements, amendments, and notices must be stored, tracked, and validated to avoid risk. As portfolios grow, documentation accuracy becomes harder to maintain manually.

Core responsibilities of a multifamily property manager

A multifamily property manager acts as the operational lead across all portfolio activities. The scope of multifamily property management services covers several interconnected functions, whether the manager works directly for an owner or through a third-party firm.

Tenant relations and resident retention

Move-in coordination, lease renewals, and ongoing resident communication fall here. Retention has a direct line to vacancy costs, every turnover triggers make-ready expenses, marketing spend, and lost rent during the vacancy period. Strong tenant relations reduce churn and protect NOI.

Leasing and marketing for vacancy reduction

Listing available units, screening applicants, executing leases, and managing lease terms are central to this function. Multifamily property managers balance speed-to-lease with resident quality, particularly as units now take an average of 41 days to lease, a record high. A rushed screening process might fill units quickly but increase delinquency risk or turnover down the road.

Financial management and rent collection

Rent invoicing, payment tracking, delinquency follow-up, and owner reporting keep cash flowing. When follow-up is inconsistent, small balances compound into larger write-offs. Disciplined collection workflows are the difference between predictable cash flow and monthly surprises.

Maintenance coordination and property upkeep

Work order management, vendor coordination, and preventive maintenance schedules keep the physical asset in condition. Deferred maintenance creates compounding capital costs and erodes resident satisfaction, which in turn affects retention.

Compliance documentation and audit trails

Maintaining signed leases, addenda, notices, and regulatory filings protects against legal exposure. Documentation gaps often surface during property transitions or litigation, exactly when they cause the most damage.

| Responsibility | Key Activities | NOI Impact |

|---|---|---|

| Tenant Relations | Move-ins, renewals, communication | Retention reduces turnover costs |

| Leasing | Marketing, screening, lease execution | Vacancy days equal lost revenue |

| Financial Management | Rent collection, delinquency follow-up | Cash flow consistency |

| Maintenance | Work orders, vendor management | Deferred costs compound |

| Compliance | Document storage, audit readiness | Legal risk mitigation |

The Role of Software in Multifamily Property Management

Modern multifamily property management software provides the operational backbone for day-to-day execution. These systems typically support:

-

Leasing and resident records

-

Rent and payment tracking

-

Maintenance workflows

-

Communication across teams and residents

-

Portfolio-level visibility

Software creates consistency, reduces manual work, and enables teams to manage more units with fewer operational bottlenecks.

For a broader view of how property management fits into the technology ecosystem, see Multifamily Technology & Software →

Where Traditional Property Management Falls Short

Even with modern software, many multifamily property management teams face challenges:

-

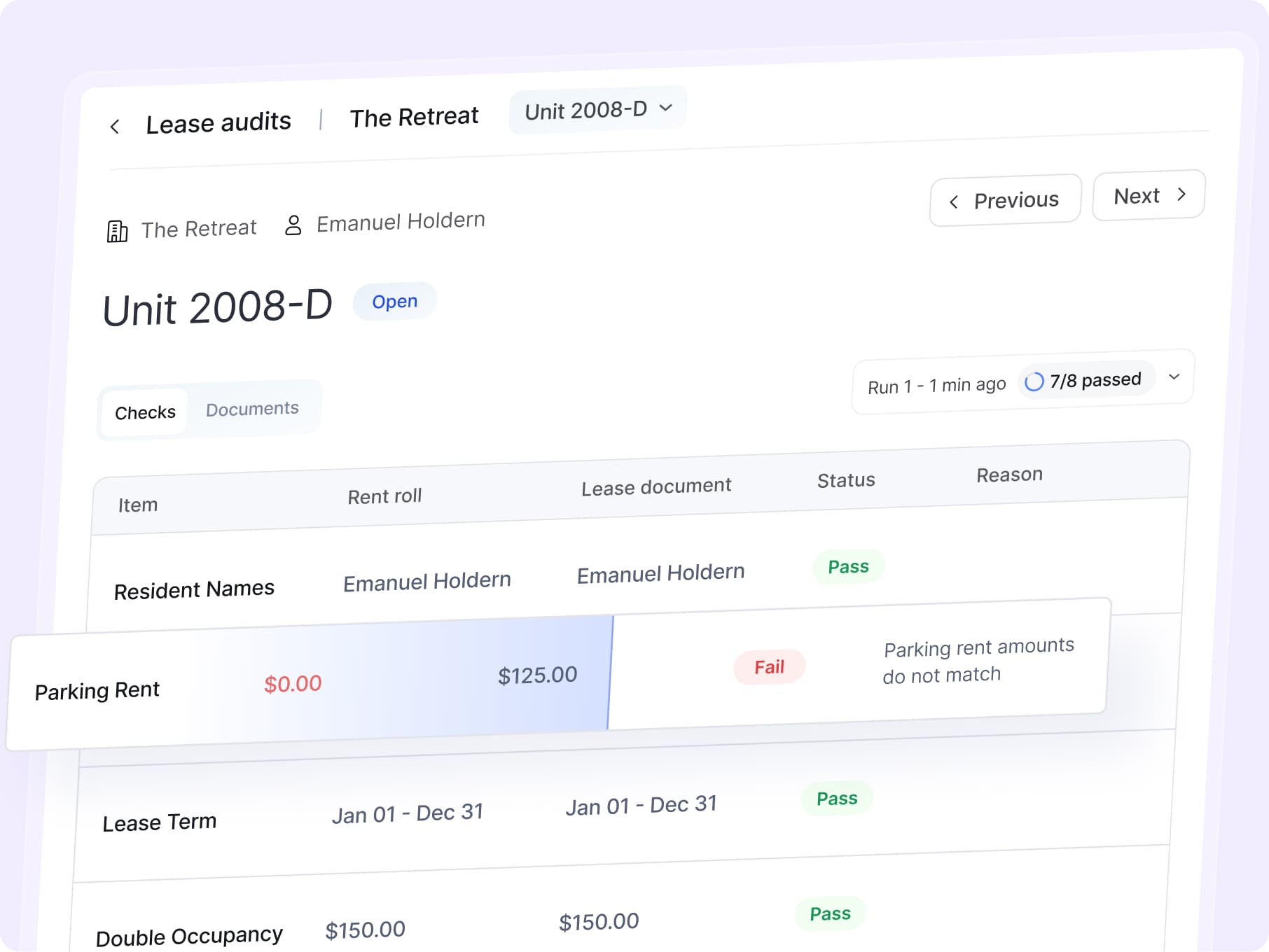

Lease data inconsistencies across systems

-

Manual review of complex lease terms

-

Periodic audits instead of continuous validation

-

Limited visibility into document accuracy

These gaps create downstream risk in reporting, compliance, and asset performance.

This is where AI-driven oversight becomes increasingly valuable.

Why multifamily management challenges erode NOI

Even experienced multifamily property management companies struggle to execute consistently at scale. The operational pain points below are not signs of incompetence, they are structural weaknesses in how most portfolios operate.

High tenant turnover and vacancy loss

Each turnover triggers a cascade of costs: unit make-ready, marketing, staff time for showings, and lost rent during vacancy. An NAA survey found 53.8% of firms report turn costs between $1,500 and $3,500 per unit. Turnover is partly controllable through resident experience, but only if teams have bandwidth to focus on retention rather than administrative tasks.

Revenue leakage from missed charges and billing errors

Revenue leakage refers to charges that belong on tenant ledgers but never appear, pet fees, utility reimbursements, storage, parking, or incorrect rent amounts after renewals. Manual lease-to-ledger matching misses errors, especially when lease terms are buried in PDFs and ledgers live in a separate system.

Consider a portfolio with 2,000 units losing $15 per unit monthly in missed charges. That adds up to $360,000 annually in revenue that simply disappears.

Manual processes that break at scale

Spreadsheet-based audits, paper checklists, and email-driven workflows work for a single property. They fail across a portfolio. Without workflow automation, what looks manageable at 200 units becomes unsustainable at 2,000 units without proportional headcount increases.

Compliance exposure from documentation gaps

Unsigned documents, missing addenda, and out-of-policy concessions create audit findings and legal risk. Problems often surface only during due diligence or litigation, exactly when they are most expensive to fix.

Fragmented data across property management systems

Data spreads across PMS platforms, cloud storage, email threads, and spreadsheets. When a regional manager asks a simple question, “Which properties have the highest delinquency?” – the answer often requires hours of manual compilation. Fragmented data prevents portfolio-wide visibility and slows decision-making.

Calculating the cost of operational inefficiency in multifamily real estate

Framing inefficiency as a measurable NOI drag helps justify investment in better tools and processes. The categories of cost include:

- Vacancy and turnover costs: Make-ready, marketing, and lost rent during vacancy periods

- Revenue leakage: Uncharged fees, incorrect rent amounts, missed escalations

- Administrative labor: Hours spent on manual audits, document filing, delinquency calls

- Compliance remediation: Legal fees, audit findings, rework during transitions

Multifamily property management fees from third-party firms often reflect the cost of absorbing inefficiencies. A firm charging 4% of gross rent may seem expensive, but if internal operations leak 2% of potential revenue through errors and vacancies, the comparison shifts.

The Role of AI in Multifamily Property Management

AI is emerging as a critical layer within multifamily operations, not to replace property management software, but to strengthen it.

AI in multifamily property management is used to:

-

Validate lease and document data

-

Automate repetitive review tasks

-

Surface discrepancies and risk patterns

-

Support faster operational decision-making

For a deeper look at this evolution, see multifamily AI automation →

How automation drives NOI for multifamily property management companies

Connecting tools back to financial outcomes clarifies the business case for investing in operational technology.

Continuous monitoring replaces periodic audits

With continuous monitoring, issues caught immediately can be corrected before month-end close, recovering revenue that periodic audits would miss until the next review cycle. A missed pet fee caught on day three is recoverable. The same fee caught during a quarterly audit may require awkward resident conversations or write-offs.

Faster delinquency resolution improves cash flow

Automated outreach ensures no delinquent account is overlooked and follow-ups happen on schedule. Reducing days outstanding improves cash flow predictability for asset managers tracking portfolio performance.

Reduced compliance risk protects asset value

Complete, verified documentation reduces legal exposure and prevents costly findings during audits or due diligence. In rent-controlled markets, even small errors in the delinquency process can lead to legal judgments.

Unified data enables smarter investment decisions

Portfolio-wide visibility lets asset managers identify underperforming properties, benchmark operations, and prioritize capital allocation. When data lives in one place, questions get answered in minutes rather than days.

What to evaluate when selecting multifamily property management firms or vendors

Whether evaluating third-party multifamily property management companies or technology vendors, the focus belongs on operational capabilities rather than brand reputation.

Integration capabilities with existing systems

The ability to connect to current PMS, accounting, and storage tools without requiring full platform replacement determines adoption speed. Tools that require rip-and-replace implementations rarely get implemented.

Scalability across growing portfolios

Assessing whether a firm or tool can handle portfolio growth without proportional headcount increases protects margin as the portfolio expands. A solution that works at 1,000 units but requires double the staff at 2,000 units is not scalable.

Reporting transparency and audit trail access

Clear reporting on what was flagged, what was resolved, and what remains open supports owner reporting and compliance. Opacity in vendor reporting creates risk.

Support for property transitions and takeovers

Acquisitions and management transitions are high-risk moments. Evaluating how firms or tools handle document migration and data validation reveals operational maturity.

| Criterion | Questions to Ask | Why It Matters |

|---|---|---|

| Integration | Which PMS platforms are supported? | Avoids manual data exports |

| Scalability | How does pricing change with unit count? | Protects margin as portfolio grows |

| Reporting | Can I see audit history and resolution status? | Supports owner reporting and compliance |

| Transitions | What is the process for property takeovers? | Reduces risk during acquisitions |

How SurfaceAI Supports Multifamily Property Management

SurfaceAI is not a property management system. Instead, it operates as an AI agent layer that integrates with existing multifamily software to improve accuracy and automation across critical workflows.

SurfaceAI supports property management teams through:

Lease Accuracy Validation

The Lease Audit Agent reviews executed leases to identify discrepancies between contract terms and operational data. Learn more about the Lease Audit AI Agent →

Acquisition and Transition Support

During ownership changes or portfolio onboarding, the Due Diligence Agent accelerates lease and document review. Explore Due diligence AI Agent →

Document Organization and Oversight

The Document Management Agent structures and validates lease and operational files, reducing downstream errors. Explore Document Management AI Agent →

Together, these agents enhance the reliability of multifamily property management workflows without disrupting existing systems.

“The audit program from SurfaceAI was a game-changer for us. This structure helped us identify and capitalize on missed opportunities for revenue, turning what was once a blind spot into a source of income.”

Glennette Calero, Property Manager

Technology-Driven Property Management in the U.S. Multifamily Market

Technology adoption in multifamily property management is closely tied to portfolio scale. Large U.S. operators manage tens of thousands of units across markets, making standardized processes and centralized systems essential.

Industry research from the National Multifamily Housing Council highlights how leading operators rely on technology to support leasing, operations, and asset oversight across expansive portfolios.

(Reference: National Multifamily Housing Council – NMHC 50 Largest Apartment Owners and Managers)

How modern operators build an operations-first multifamily management strategy

Leading multifamily real estate property management companies are shifting from reactive to proactive operations. In Deloitte’s 2024 commercial real estate survey, over 72% of owners and investors reported committing funds to AI-enabled solutions. The pattern involves deploying AI agents, like those offered by SurfaceAI – as digital teammates handling continuous oversight so human teams focus on exceptions and strategy.

Treating operational consistency as a competitive advantage changes how portfolios perform. Delinquency will always exist, but inconsistency no longer has to. Automation turns reactive processes into proactive capabilities, reduces compliance exposure, and restores valuable hours to onsite teams.

As operating margins tighten and resident expectations evolve, the ability to manage rent collection, lease compliance, and portfolio visibility with precision separates top-performing operators from the rest.

FAQs about multifamily property management