Lease Portfolio Management Best Practices and Benefits

Lease portfolio management is the strategic oversight, tracking, and optimization of an organization’s entire collection of lease agreements, real estate, equipment, and vehicles – to reduce costs, ensure compliance, and maximize asset utilization. When it works, portfolios run smoothly. When it doesn’t, revenue leaks through missed charges, compliance gaps trigger audit findings, and teams drown in spreadsheets.

This guide covers what lease portfolio management includes, why it breaks down at scale, and the best practices that protect NOI and keep operations running cleanly.

What Is Lease Portfolio Management

Lease portfolio management is the strategic oversight, tracking, and optimization of an organization’s entire collection of lease agreements. Whether those agreements cover real estate, equipment, or vehicles, the goal remains the same: reduce costs, ensure compliance with accounting standards like ASC 842 or IFRS 16, and maximize asset utilization. In practice, this means centralizing data, managing renewals and payments, and monitoring risks across every lease in the portfolio.

Without a clear system in place, organizations face revenue leakage from missed charges, compliance exposure from incomplete documentation, and operational chaos from scattered data. A single missed rent escalation across a 50-property portfolio can cost tens of thousands annually. Compliance failures under ASC 842 can trigger audit findings and financial restatements that shake investor confidence.

What Is a Corporate Lease

A corporate lease is a contractual agreement where an organization leases property or equipment from a lessor for business operations. Unlike residential leases, corporate leases typically involve longer terms, more complex provisions, and additional charges like common area maintenance (CAM) fees and annual escalation clauses.

The distinction matters because corporate leases require different management approaches:

- Real estate leases: Office, retail, and industrial spaces with terms often spanning five to ten years, renewal options, and tenant improvement allowances

- Equipment leases: Vehicles, machinery, and technology assets with end-of-term purchase options and residual value considerations

What Lease Portfolio Management Includes

The day-to-day work of lease portfolio management spans several interconnected activities. Each one depends on the others, so a breakdown in one area often cascades into problems elsewhere.

Lease data entry and maintenance

Every lease portfolio starts with accurate data capture. This means recording lease terms, critical dates, rent amounts, escalation schedules, and key clauses in a centralized system. Accuracy here is foundational, if the base rent or commencement date is entered incorrectly, every downstream calculation will be wrong.

Payment processing and rent tracking

Monitoring rental payments, CAM charges, escalations, and reconciliations is where revenue protection happens. Missed payments lead to penalties, strained landlord relationships, and cash flow disruptions. For tenants, tracking outgoing payments ensures you’re not overpaying. For landlords, tracking incoming payments ensures you’re collecting what’s owed.

Document administration and storage

Lease agreements, amendments, correspondence, and supporting documents all require organized storage. When an audit request arrives or a renewal decision looms, teams need immediate access to the relevant paperwork. Scattered documents across email threads, filing cabinets, and shared drives create delays and increase the risk of decisions made on incomplete information.

Compliance monitoring and reporting

Lease accounting standards-ASC 842 for U.S. companies and IFRS 16 internationally-require organizations to recognize most leases on their balance sheets. This means tracking lease liabilities, right-of-use assets, and generating reports for auditors and stakeholders. Non-compliance can result in audit findings, financial restatements, and reputational damage with investors and lenders. The FASB’s ongoing post-implementation review of ASC 842 signals the standard continues to evolve, making continuous compliance readiness essential.

Why Lease Portfolio Management Is Difficult

Even well-intentioned teams struggle with lease portfolio management. The challenges are structural, not just operational.

Fragmented data across multiple systems

Lease information often lives in spreadsheets, emails, filing cabinets, and disconnected property management systems. One person tracks renewals in Outlook, another maintains a master spreadsheet, and a third stores documents in a shared drive. This fragmentation makes portfolio-wide visibility nearly impossible.

Manual processes that cannot scale

As portfolios grow, manual tracking becomes unsustainable. A team that can manage 20 leases in spreadsheets will drown at 200, making automated lease administration essential. The administrative burden grows faster than headcount, and teams spend more time on data entry than strategic work.

Revenue leakage from missed charges

Incorrect rent amounts, missed escalations, and overlooked fees result in lost revenue that compounds over time. Industry estimates suggest revenue leakage from lease administration errors can range from 1% to 3% of total rent, a significant hit to net operating income (NOI).

Incomplete documentation, missed reporting deadlines, and non-compliance with lease accounting standards create audit risk.

Incomplete documentation, missed reporting deadlines, and non-compliance with lease accounting standards create audit risk. The consequences range from qualified audit opinions to financial restatements.

Best Practices for Lease Portfolio Management

Organizations that manage lease portfolios effectively share common practices. The following are operational disciplines that protect revenue and reduce risk.

1. Centralize all lease data in one platform

A single source of truth for all lease information eliminates version confusion and enables portfolio-wide analysis. Centralization also simplifies onboarding new team members and reduces key-person risk when employees leave.

2. Assign clear ownership to a lease manager or team

Dedicated accountability prevents tasks from falling through the cracks. Whether it’s a single lease manager or a distributed team with defined responsibilities, someone needs to own the process. Without clear ownership, everyone assumes someone else is handling it, until a critical date passes unnoticed.

3. Conduct continuous audits rather than periodic reviews

Issues caught early are easier and cheaper to resolve. A missed charge discovered in week one costs far less than one discovered at year-end. Traditional quarterly or annual audits create gaps where problems compound. AI-powered tools like SurfaceAI’s Lease Audit Agent enable continuous oversight, flagging discrepancies the moment they appear rather than months later.

4. Automate routine workflows and notifications

Critical date alerts, renewal reminders, and payment tracking can all be automated. Automation reduces manual effort, eliminates human error, and ensures nothing slips through the cracks. It doesn’t replace human judgment, it frees humans to focus on decisions that require judgment.

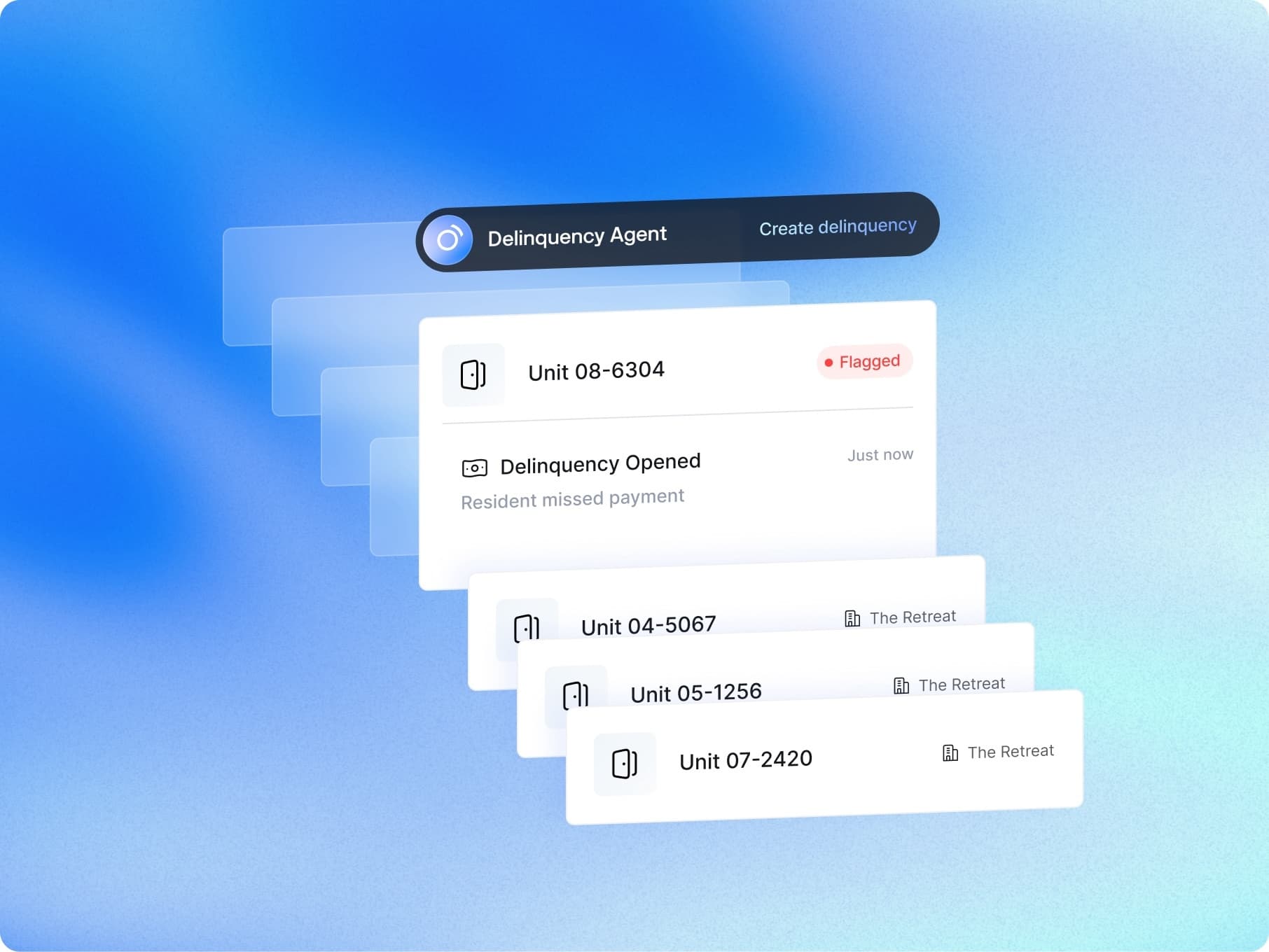

5. Integrate lease management with collections workflows

Lease terms and rent collection are connected. When lease data flows directly into delinquency management, teams can respond faster to missed payments and maintain consistent communication. Unified workflows, such as those connecting lease data to automated delinquency follow-up, protect revenue end-to-end.

6. Use real-time reporting for portfolio-wide visibility

Dashboards and reports that show portfolio health at a glance enable faster decision-making. Asset managers can spot trends, identify underperforming properties, and prioritize attention where it matters most.

Benefits of Effective Lease Portfolio Management

When lease portfolio management works well, the benefits compound across the organization.

- Reduced revenue leakage and higher NOI: Catching missed charges, incorrect rents, and out-of-policy concessions protects net operating income

- Lower administrative overhead: Automation and centralization free property teams from manual spreadsheet work

- Stronger compliance and audit readiness: Organized, accessible lease data simplifies audits and reduces compliance risk

- Better data for faster decisions: Reliable portfolio data supports strategic decisions like renewals, terminations, and lease-versus-buy analysis

- Scalability across growing portfolios: Proper systems allow organizations to add properties without proportionally increasing administrative burden

What to Look for in Lease Portfolio Management Software

Not all lease management software is created equal. When evaluating options, the following capabilities matter most:

| Feature | What It Does | Why It Matters |

|---|---|---|

| Centralized data repository | Stores all lease documents and data in one location | Eliminates version confusion and enables portfolio-wide analysis |

| Automated alerts | Sends notifications for critical dates and milestones | Prevents missed renewals, expirations, and payment deadlines |

| Real-time reporting | Generates on-demand portfolio analytics | Supports faster, data-driven decisions |

| System integration | Connects with existing PMS and accounting tools | Reduces duplicate data entry and syncs information automatically |

| Compliance tracking | Monitors ASC 842/IFRS 16 requirements | Ensures audit readiness and reduces restatement risk |

Role of the Lease Manager in Portfolio Operations

The lease manager serves as the central point of accountability for lease administration. This person, or team, ensures data accuracy, monitors critical dates, coordinates with stakeholders, and resolves discrepancies.

Key responsibilities typically include:

- Data stewardship: Ensuring lease information is accurate and current

- Critical date management: Tracking renewals, expirations, and option deadlines

- Stakeholder coordination: Liaising between property teams, finance, and legal

- Issue resolution: Investigating and correcting discrepancies flagged by audits

Technology supports but does not replace this role. Even the best software requires human oversight to interpret exceptions, make judgment calls, and maintain relationships with landlords and tenants.

How to Select Lease Portfolio Management Software

Choosing the right software requires matching capabilities to your specific needs.

1. Assess your portfolio size and complexity

Requirements differ based on number of leases, property types, and geographic spread. A 20-lease portfolio has different needs than a 2,000-lease portfolio spanning multiple states.

2. Match features to your operational priorities

Identify your biggest pain points, compliance, revenue leakage, manual effort and prioritize features accordingly. Not every organization needs every feature.

3. Verify integration with existing systems

Confirm compatibility with current property management systems, accounting software, and document storage. Software that creates new data silos defeats the purpose.

4. Evaluate vendor support and implementation

Onboarding assistance, training, and ongoing customer support matter as much as features. The best software fails if teams can’t use it effectively.

5. Plan for scalability and future needs

Select software that can grow with your portfolio and adapt to evolving requirements. Switching systems is expensive and disruptive.

The Future of Lease Portfolio Management

AI and automation are transforming lease management from reactive administration to proactive operations. Morgan Stanley projects the real estate industry could realize $34 billion in efficiency gains from AI over the next five years. AI agents can now perform continuous audits, flag issues in real time, and automate workflows that previously required manual intervention.

This shift represents more than efficiency gains. It changes the fundamental operating model, from periodic reviews that catch problems after the fact to continuous oversight that prevents problems before they compound.

Platforms like SurfaceAI exemplify this evolution, deploying AI agents that act as digital teammates rather than passive tools. The agents monitor leases continuously, surface discrepancies automatically, and integrate with collections workflows to protect revenue across the resident lifecycle.

Book a demo to see how AI-powered lease portfolio management works in practice.

Frequently Asked Questions about Lease Portfolio Management

Related content