From Monthly Reports to Real-Time Control: Why Multifamily Operators Must Embrace Continuous Financial Monitoring

Most multifamily operators still rely on monthly or quarterly financial reporting to assess performance. Yet rent roll inaccuracies, delayed reconciliations, and lagging indicators create blind spots that can materially affect asset value and investor confidence. In an environment where NOI growth is critical, the shift to real-time financial oversight is not simply a technology upgrade, it is a competitive necessity. This article explores how real-time data is reshaping financial discipline in multifamily, and why operators who fail to adapt risk falling behind.

Traditional Reporting Is No Longer Sufficient

Multifamily finance has long operated on a fixed cadence. Owners review budget variance reports monthly, audit rent rolls quarterly, and analyze performance trends at year-end. This approach worked when property performance changed slowly, capital flows were consistent, and market transparency was low.

Today, the stakes have changed. Cap rates are compressing, institutional investors demand real-time transparency, and regulatory environments are tightening. Most importantly, property performance can shift dramatically within weeks, whether due to a surge in delinquency, an operational oversight, or a change in lease mix. Waiting until the end of the month to spot revenue leakage or operational issues is too late.

According to the National Apartment Association, the average rent discrepancy per unit identified in year-end audits exceeds $120, often due to missed fees, misapplied concessions, or renewal errors. For a 5,000-unit portfolio, that equates to more than $600,000 in missed annual revenue, largely invisible in standard monthly financials until after the fact.

What Real-Time Monitoring Actually Means

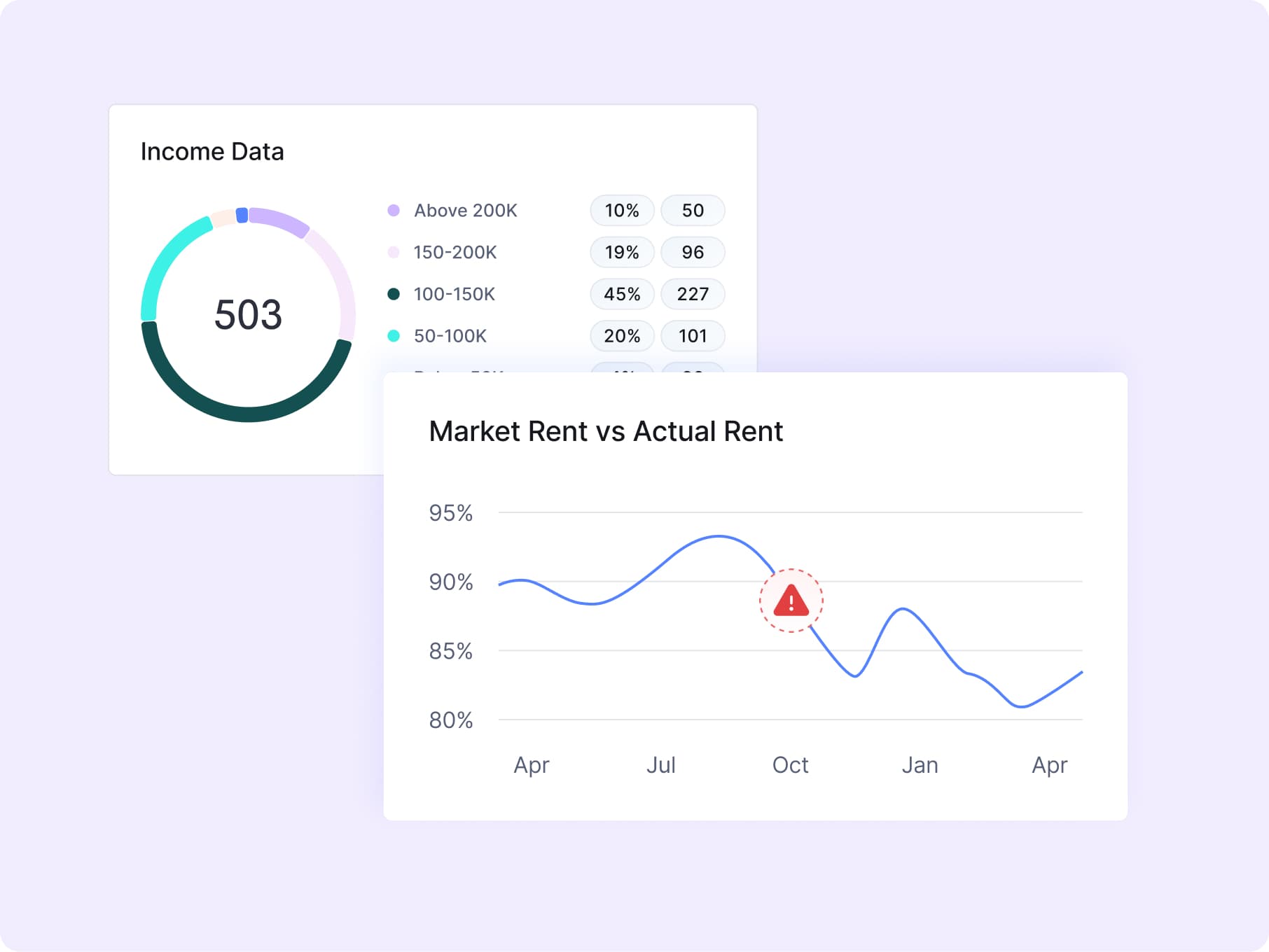

Real-time financial monitoring is not simply about dashboards. It refers to a system of continuous oversight that tracks every dollar of revenue, expense, and receivable on a daily basis, comparing actuals to contractual terms, forecast models, and historical norms.

This includes automatic comparison of executed leases to rent rolls, detection of unbilled charges, monitoring of concession expirations, and alerts for abnormal trends in vacancy, delinquency, or renewals. These alerts are routed to the relevant teams for immediate resolution, and full audit logs are maintained for internal and external review.

By transforming financial oversight from episodic to continuous, operators are better equipped to manage risk, respond to anomalies, and provide capital partners with greater confidence in reported results.

The Value of Moving from Reactive to Proactive

Real-time financial visibility creates multiple strategic advantages:

-

- Accelerated Decision-Making

When asset managers have daily visibility into lease-level performance, they can respond to emerging trends faster. For example, spotting a drop in scheduled rent or a sudden increase in renewals below market rate allows for corrective action before it impacts quarterly returns.

- Reduced Revenue Leakage

Most missed charges, whether pet rent, amenity fees, or renewal escalations, stem from input errors or system misalignments. By surfacing these discrepancies immediately, operators can correct them before they compound.

- Audit Readiness

Capital partners and lenders are increasingly requesting more granular, real-time performance data. Operators who maintain real-time financial logs and reconciliation histories can respond quickly and credibly to diligence requests, improving relationships and reducing execution risk. - Performance Transparency

Internal stakeholders gain confidence in the accuracy of reported NOI. Regional leaders and executives can track whether local teams are executing rent increases, applying fees consistently, or falling behind on collections.

- Accelerated Decision-Making

Implications for Capital Markets

In a recent survey of institutional real estate investors by Preqin, 67 percent cited “timeliness and reliability of data” as a primary factor in their asset management assessments. Properties that require manual reconciliation or frequent restatements lose credibility, and may face additional scrutiny during refinancing or recapitalization.

Some CMBS issuers and private lenders are beginning to evaluate the operational reporting capabilities of borrowers. Real-time monitoring is increasingly seen as a marker of institutional maturity. For operators with capital-intensive growth plans, the ability to provide real-time performance assurance can directly influence access to capital and the pricing of debt.

Implementation Considerations

For operators looking to adopt real-time monitoring, success depends on aligning data, people, and process.

- System Integration

Operators must ensure lease data, rent rolls, financial ledgers, and concession records are connected. This often means integrating property management systems with analytics tools and defining consistent data structures across the portfolio.

- Governance and Alerts

Too many alerts can overwhelm teams. Executives must define thresholds for materiality, escalation paths for exceptions, and ownership for issue resolution.

- Change Management

Real-time monitoring changes how performance is managed. Teams must be trained to respond to issues proactively, not reactively. Success should be measured not just by reducing errors, but by how quickly they are resolved.

From Reporting to Intelligence

Real-time oversight creates a flywheel effect: early detection leads to faster resolution, which leads to cleaner data, which improves forecast accuracy, which informs better decisions. Over time, the organization becomes more nimble, more accurate, and more trusted by capital partners.

This shift mirrors what has already happened in other industries, finance, logistics, retail, where static reporting has been replaced by continuous intelligence. Multifamily operations are next. As the sector becomes more institutional and capital flows tighten, execution quality matters more than ever.

Precision Is Performance

In today’s multifamily environment, the ability to understand financial performance in real time is no longer optional. It is a core competency. Operators who adopt continuous financial monitoring will identify risks faster, make better decisions, and outperform peers who still operate on a 30-day delay. In an era where even small deviations can impact valuation, real-time accuracy is not just an efficiency gain. It is a performance mandate.