Delinquency Management Needs a Reset: Automating Rent Collection to Protect NOI and Compliance

As rent collection processes become more complex and tenant expectations more digital, manual delinquency management remains one of the most operationally fragile and financially risky workflows in multifamily. Inconsistent follow-up, human error, and reactive processes erode net operating income, damage resident relationships, and expose owners to compliance risk. This article examines how automation is transforming delinquency management into a standardized, scalable function, protecting revenue, reducing legal exposure, and freeing up onsite teams to focus on performance rather than process.

The Structural Weakness in Rent Collection

In many multifamily organizations, the rent collection process remains a manual sequence: rent is due on the first of the month, follow-up notices are sent by the fifth or tenth, and personal outreach is left to local site staff. This system depends heavily on spreadsheets, calendar reminders, and individual discretion. The result is fragmented execution across properties, inconsistent tenant experience, and uneven financial outcomes.

While total U.S. rent collection rates remain relatively stable in most Class A and B portfolios, small fluctuations can have outsized effects. According to RealPage, a 1 percent decline in rent collection across a 3,000-unit portfolio at $1,800 average rent equates to more than $650,000 in lost annual revenue. What’s more, late payments that are mishandled often lead to downstream disputes, legal action, or lease non-renewal, outcomes that increase turnover costs and impair occupancy.

The risks are not limited to revenue loss. In many states, fair housing regulations and eviction moratoria have changed the legal parameters around delinquency communications. Errors in notice timing, tone, or documentation can result in regulatory fines or litigation. In a 2023 survey of property management firms by the Institute of Real Estate Management (IREM), 41 percent cited delinquency-related compliance issues as a top operational concern.

The Problem with Manual Collection Workflows

Manual processes often break down at key inflection points. Leasing agents may forget to send notices on time. Property managers may lack visibility into which residents received payment plans versus legal notices. Regional managers may assume delinquency is under control because the data they see is incomplete or outdated.

These inconsistencies create three structural problems:

- Operational drag: Staff must spend significant time reconciling balances, tracking follow-ups, and engaging in back-and-forth with residents. This is non-revenue-generating work and distracts from leasing and retention priorities.

- Reputational risk: Residents talk. If one tenant receives a lenient payment plan and another is sent a legal notice for the same infraction, perceived unfairness can erode resident trust and lead to reviews, disputes, or complaints.

- Regulatory vulnerability: Inaccurate or undocumented communication may violate local ordinances, particularly in jurisdictions with strict notification protocols. In rent-controlled cities, even small errors in the delinquency process can lead to legal judgments or license issues.

Automating the Delinquency Lifecycle

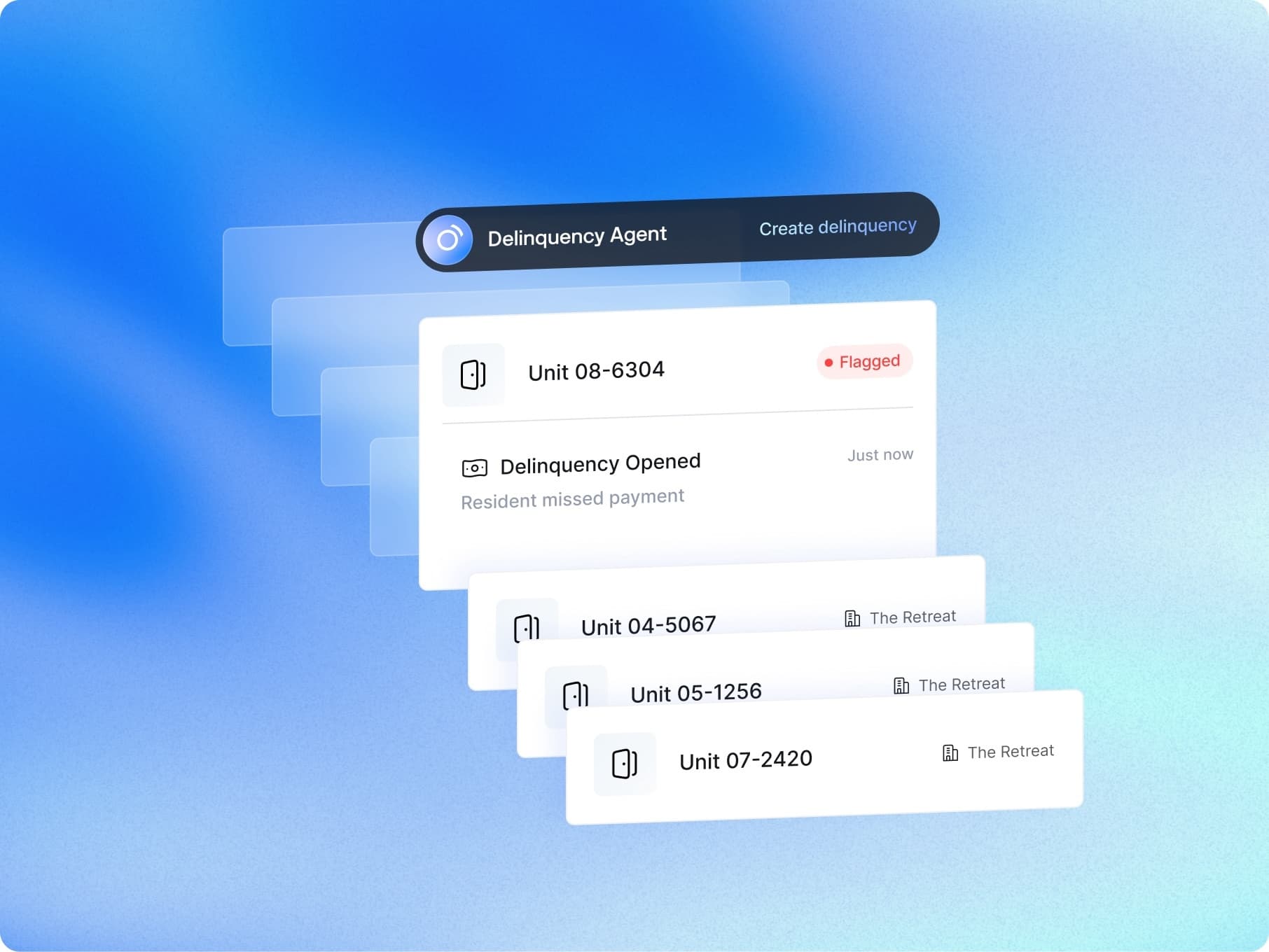

Automated delinquency management offers a solution that standardizes communication, improves consistency, and creates a defensible audit trail. The model is simple: when rent is not received, automated systems trigger notices, reminders, and escalation steps according to predefined business rules and legal requirements.

These rules can vary by state, asset class, or resident history. For example, a tenant with a prior payment plan might receive a reminder with an option to renegotiate. A tenant in a property with local eviction restrictions might receive only informational notices until a specific threshold is met. In all cases, automation ensures the right message goes to the right resident, at the right time, through the right channel.

Automation also improves data integrity. Every notice is timestamped, every communication logged, and every action tracked, giving operators full visibility into resident status, staff action, and compliance posture. This reduces exposure in the event of legal disputes and improves decision-making for asset managers tracking portfolio performance.

Financial and Operational Benefits

Operators who have implemented automated delinquency management report substantial gains. A regional owner with 7,000 units across the Sunbelt reduced late payments by 38 percent in the first six months post-automation. Another large operator cut average time-to-resolution for delinquencies by 45 percent, freeing site staff to focus on leasing and resident engagement.

Beyond efficiency, the predictability of cash flow improves. Instead of volatile delinquency swings driven by site-level execution, asset managers can forecast collections with greater confidence. Delinquency is no longer a recurring “fire drill,” but a managed process with clear metrics, targets, and accountability.

Importantly, automation also improves the resident experience. Clear, timely, and respectful communication helps residents understand expectations, avoid escalation, and feel treated fairly. In a competitive market, consistency is not just good governance, it is good business.

Consistency is the Competitive Advantage

Delinquency will always exist, but inconsistency no longer has to. Automation turns a reactive process into a proactive capability, reduces compliance exposure, and restores valuable hours to onsite teams. As operating margins tighten and resident expectations evolve, the ability to manage rent collection with precision, predictability, and professionalism will separate top-performing operators from the rest. In multifamily today, the most valuable processes are not just efficient, they are automated, auditable, and aligned with long-term performance.